AMD to Acquire Silo AI, TSMC rules 👑, Etched Series A Wows 🦄

Nvidia stock $NVDA is up another 180% so far this year, and we're only in July!

Hello Everyone,

This is an issue for the weeks catching up (last issues was June 20th) to the present time till today July 11th, so we’re a bit behind schedule. There may be times during the summer or a slow week in news, where I miss a week or two. I’m always watching this stuff, just won’t be publishing as often (June/July).

This is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Support me doing this for as low as $1 a week. Please see my archives for more on what to expect.

Welcome to the 12th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

Analyzing and Curating News 🔔

I’m a news fanatic always analyzing the latest in exponential and emerging tech like robotics, semiconductors & AI chips, quantum, synthetic biology and other fields - as well as BigTech in AI. You might not know this but my flagship Newsletter is:

When to Expect this Newsletter ⏰

This Newsletter will typically go out on Thursday at 7am Eastern Time (though sorry not today). Posts are partially paywalled and paid subscriptions are cheap.

What? It will attempt to summarize some of the most important news in the semiconductor industry of the last week.

For rundowns: Semiconductor Things

For deep dives: Semiconductor Reports

We have a lot of catching up to do, so let’s get into it:

Semiconductor Bits & Bites 📱

I call Dan the Chip whisperer, crazy what you can notice when you are based out of Taiwan. TSMC is the center of the world in this territory.

It’s time to play summer 🌊 catch-up on the semi industry.

Rob Quinn was fast to remind us that TSMC had eclipsed a $1 Trillion valuation and yeah it’s sort of a big deal.

And apologies if I’m talking about TSMC a lot these days! As Nvidia goes up, so do a lot of semis and TSMC is the chief hero among these. In Taiwan, the stock is up 82% YTD in 2024.

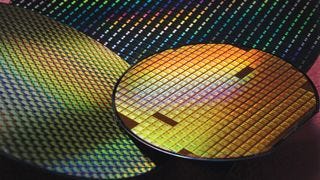

TSMC to 2-nanometers and Beyond AMD CTO Mark Papermaster sat down with TSMC Co-COO Y.J. Mii to ask: ‘‘Have we run into the fundamental limits of physics or will innovation prevail again?”

Developing manufacturing processes in the 2nm and beyond age takes longer. “In the past, indeed, it probably took 2-3 years to get things done, but right now because technology is more and more challenging, it takes more time, sometimes 5-years or even 7-years.”

TSMC works side-by-side with customers like AMD to make sure design rules for new manufacturing processes meet client needs. TSMC and other foundries provide design rules to customers, to ensure their chips are easier to manufacture.

AMD (whose CEO is also Taiwanese-American like Jensen Huang) is one of TSMC’s top 5 chip design customers.

The IDC is raising its forecast for datacenter compute and storage spending for 2024 and on our through its 2028 time horizon. Welcome to the Boomtown, everyone. Read more.

In the quarter ended in March, IDC reckons that a total of $54.4 billion was spent on compute and storage capacity around the globe. This total is set to dramatically rise by 2030.

AMD to Acquire Silo AI to Expand Enterprise AI Solutions Globally. That’s Europe’s largest private AI lab

Intel and AMD are struggling to keep up with TSMC and Nvidia respectively.

Silo AI, Europe’s largest artificial intelligence lab, develops AI models and systems that cater to individual companies, including Rolls Royce, Unilever and Allianz. The acquisition of the Helsinki-based company bolsters AMD’s arsenal of AI services as the company works to catch up with chipmaking powerhouse Nvidia. Read the CEO’s statement. Read More.

Silo AI specializes in end-to-end AI-driven solutions that help customers integrate AI quickly and easily into their products, services and operations. Their work spans diverse markets, with customers including Allianz, Philips, Rolls-Royce and Unilever. Silo AI also creates state-of-the-art open source multilingual LLMs, such as Poro and Viking, on AMD platforms in addition to its SiloGen model platform.

The acquisitions of Mipsology and Nod.ai have expanded the AMD AI ecosystem, reinforcing the company’s position as a leader in AI processing platforms. Silo AI adds to that. Still not much compared to CUDA and Nvidia’s software and partner moat.

Semiconductor Bits & Bites 📱

Samsung Electronics faces worsening labor woes as union leaders called for the strike to go on indefinitely, media report, noting the original action was to end on Wednesday. Samsung’s biggest union is demanding a 3.5% basic pay raise, as well as more transparent bonus rules.

“May the DRAM be with you”

Taiwan DRAM maker (founded in 1995) Nanya Technology’s losses continued in the 2nd quarter, a net loss NT$813 million on revenue of NT$9.92 billion, media report, but Nanya’s president said it may break even in the 3rd quarter as the DRAM market continues to improve. Nanya’s sales volume dropped 5% in Q2, but average selling prices rose 11%-13%. Gross margin turned positive at 2.9%. Nanya reported an NT$657 million loss related to Taiwan’s April 3 earthquake.

DRAM (dynamic random access memory) is a type of semiconductor memory that is typically used for the data or program code needed by a computer processor to function.

Rumor (more or less confirmed now): While TSMC is said to raise 3nm prices 5%-10% next year, the chip giant will also slash prices on 7nm family processes by up to 10% due to weak demand, media report, noting a steep drop in smartphone demand last year hurt 7nm utilization rates, as did order delays by a single client. Demand has not recovered. TSMC faced a similar situation on 28nm in 2018-2019, which it remedied by creating specialty processes.

💎 TSMC's monthly revenue in June +32.9% year-on-year to NT$207.87 billion. 2nd Quarter revenue totaled NT$673.51 billion, a new all-time high for a single quarter and beating the top end of guidance, which was NT$658.92 billion.

Softbank will put $10 Billion+ Into ARM and AI Chips

Arm plans to launch AI chips in 2025, Nikkei reports. Softbank and ARM’s stocks are also up a lot.

ARM 0.00%↑ ARM’s stock is up a staggering 170.5% so far in 2024.