An AI Bubble, Nvidia Vendor Financing, And China's Semiconductor Decoupling

But who is picking the winners? Taiwan playing defense.

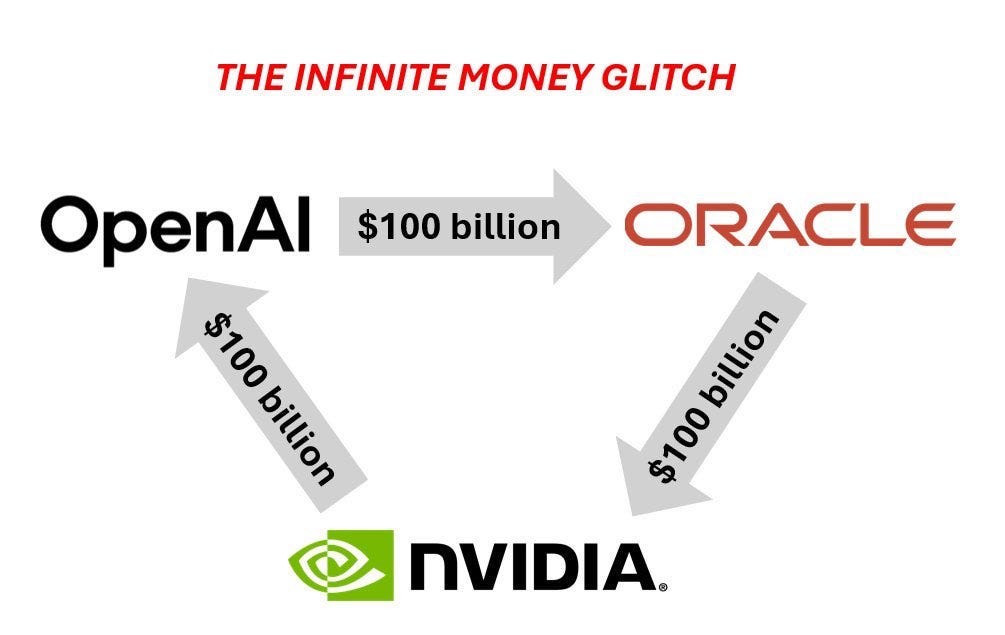

I went into some details about Nvidia’s Earnings here. As well as some of my AI bubble concerns with regards to the vendor financing of Nvidia with regards to the likes of OpenAI and CoreWeave here.

Nvidia’s Aggressive Vendor Financing may be Inflating AI Chip Sales

This however may be simply to meet capacity and the tremendous demand for compute (they may have no choice). Whatever the reason given their monopolistic marketshare on the best GPUs for datacenters, it’s highly concerning in terms of fair competition. This circular spending of money OpenAI doesn’t even have is not the most honest type of marketing and announcements and it might be them trying to create artificial moats of distribution and AI Infrastructure.

One thing is clear, is that there is a serious semiconductor boom to meet the accelerating demand for the compute that makes AI Infrastructure comparable to infrastructure projects historically like the railways system or internet infrastructure. That’s not to say that Generative AI is necessarily a (GPT) general purpose technology (e.g. it’s not creating new jobs at scale). Gen AI may only have some characteristics of a GPT, and the U.S. would likely be in a recession without the inflated and orchestrated AI boom.

Sam Altman Wants you to think that AI Infrastructure is the Trump Card of our Times

Sam Altman argues in his blog post that as artificial intelligence rapidly advances and becomes more accessible, it will drive the global economy and could eventually be viewed as a fundamental human right, with nearly everyone seeking more AI to handle tasks on their behalf. To realize this potential, OpenAI envisions building a massive factory capable of producing a gigawatt of new AI infrastructure—encompassing chips, power, and robotics—every week, primarily in the United States to accelerate development and counter faster progress elsewhere. Altman highlights transformative possibilities, such as AI curing cancer or providing personalized tutoring worldwide with sufficient compute, and promises forthcoming details on plans, partners, and financing.

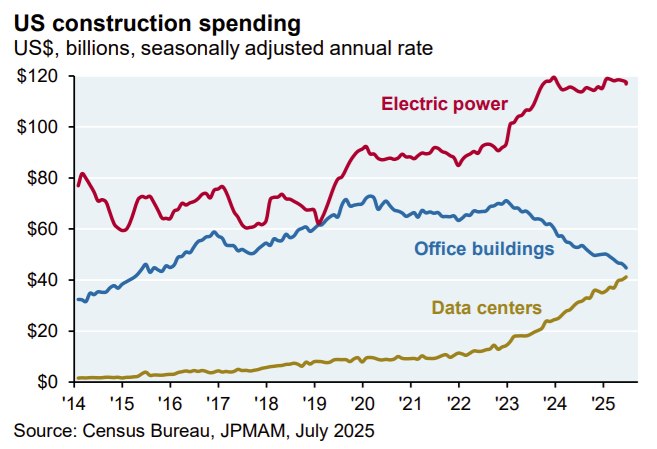

This inspite of the U.S. not having a mature energy infrastructure to even handle the demand for power that all of these new datacenters will necessitate.

Even Tech executives like Mark Zuckerberg recognize there’s a significant bubble with this AI Infrastructure capex frenzy that historically is likely to hit headwinds of one kind or another.

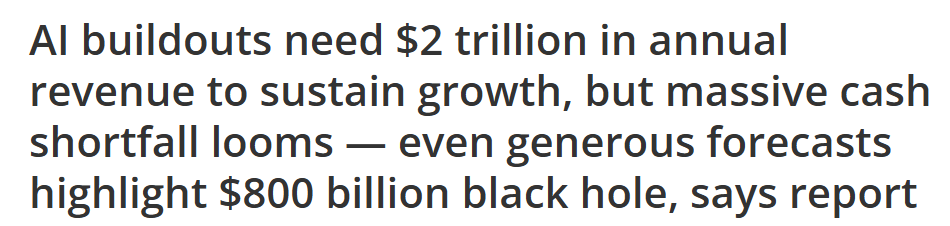

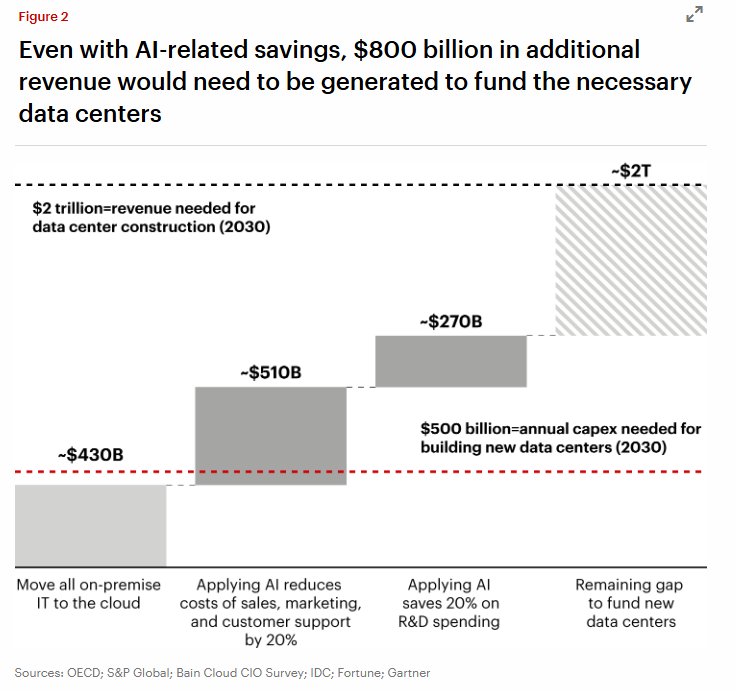

A new Bain report says AI buildout will need $2 trillion in annual revenue just to sustain its growth, and the shortfall could keep GPUs scarce and energy grids strained through 2030.

According to Bain:

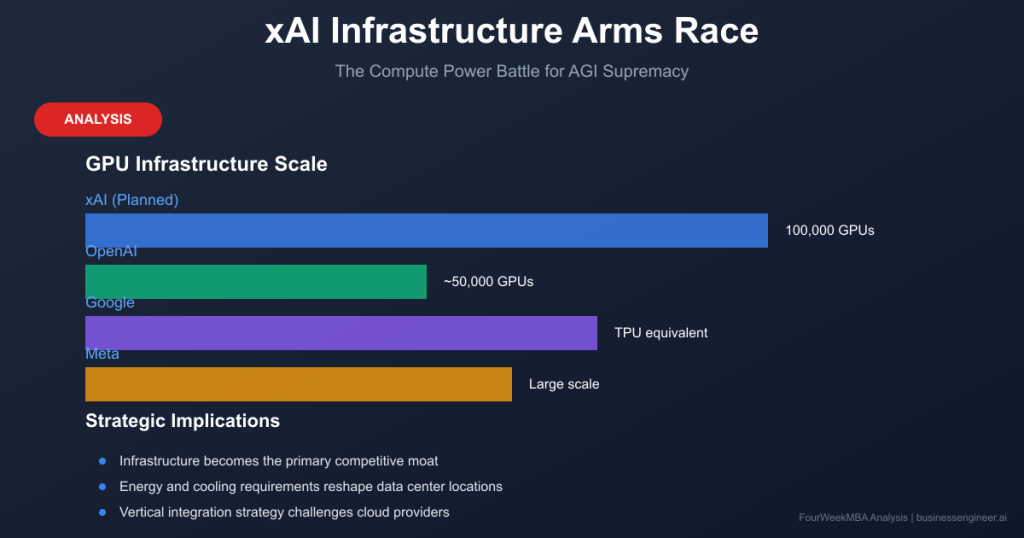

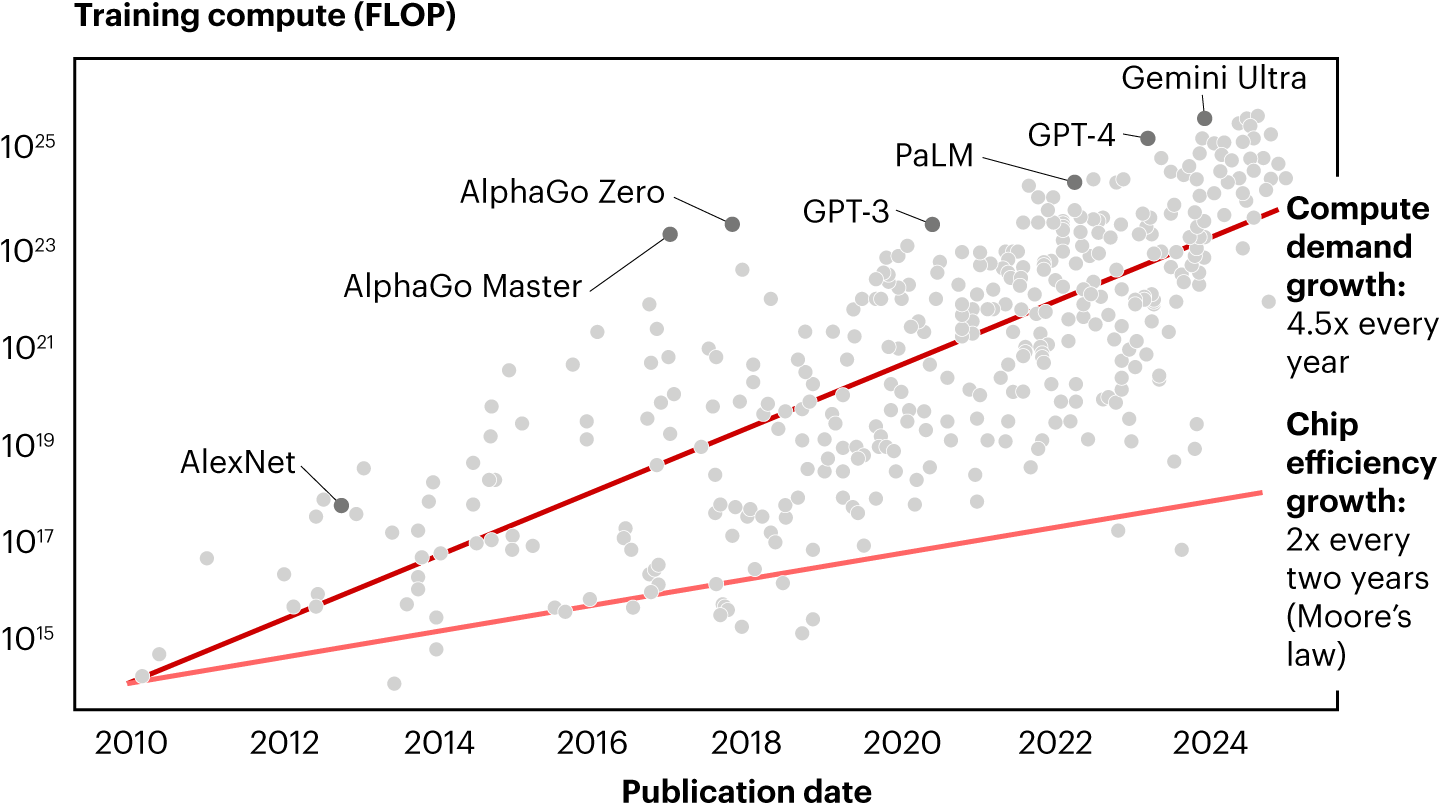

AI’s computational needs are growing more than twice as fast as Moore’s law, pushing toward 100 gigawatts of new demand in the US by 2030.

Meeting this demand could require $500 billion in annual spending on new data centers.

Here’s where it gets really wild, by 2030, AI companies will need $2 trillion in combined annual revenue to fund the computing power needed to meet projected demand, Bain said in its annual Global Technology Report released Tuesday. Yet their revenue is likely to fall $800 billion short of that mark as efforts to monetize services like ChatGPT trail the spending requirements for data centers and related infrastructure, Bain predicted.

The Return On Investment (ROI) Problem of AI Infrastructure

Many analysts point out that the near-term ROI of Generative AI and capex is not significant in the foreseeable and various reports and papers question the validity of the sizeable investment.

Bain estimates that inference and training requirements have grown at more than twice the rate of transistor density, forcing data center operators to brute-force scale rather than rely on per-chip efficiency gains.

I find it a compelling argument related to our Semiconductor topic, especially as it relates to AI Infrastructure challenges in the second half of the 2020s.

Exaggerated capex and AI Infrastructure push coinciding with a deteriorating labor demand means we are likely on the praecipe of an economic slump in 2026. The BigTech hyperscaler capex may not be healthy for the U.S. economy at a time of consumer weakness and uncertainty over the impact of Generative AI on the labor market and things like entry level jobs, software developer career ladders and changes to immigration policy that radically hurting the ability of Indians and Chinese to establish themselves in Silicon Valley. Combined with the fact that the full impact of Trump Tariffs haven’t even been felt yet, the numbers don’t really add up.

Intel getting backing from the Trump Administration, Nvidia and even maybe Apple is fairly perplexing given Intel’s general inability to compete with the likes of TSMC, AMD and others in the last few years. No amount of money is likely to enable Intel to return to former glory. With capex in AI and private market valuations of AI startups that aren’t tethered with fundamentals we are seeing technology bubble like symptoms that are pushing Semiconductor earnings up, somewhat artificially.

The New Normal

How will society find the ability to generate enough power to keep up with the demand for compute? Energy might be the bottleneck that decides the AI winners of the next decade.

S&P 500 forward P/E is now at the same level as 2021

The stock market seems more influenced by the AI boom than the real economy and existing labor market and K-shaped recovery since the Pandemic.

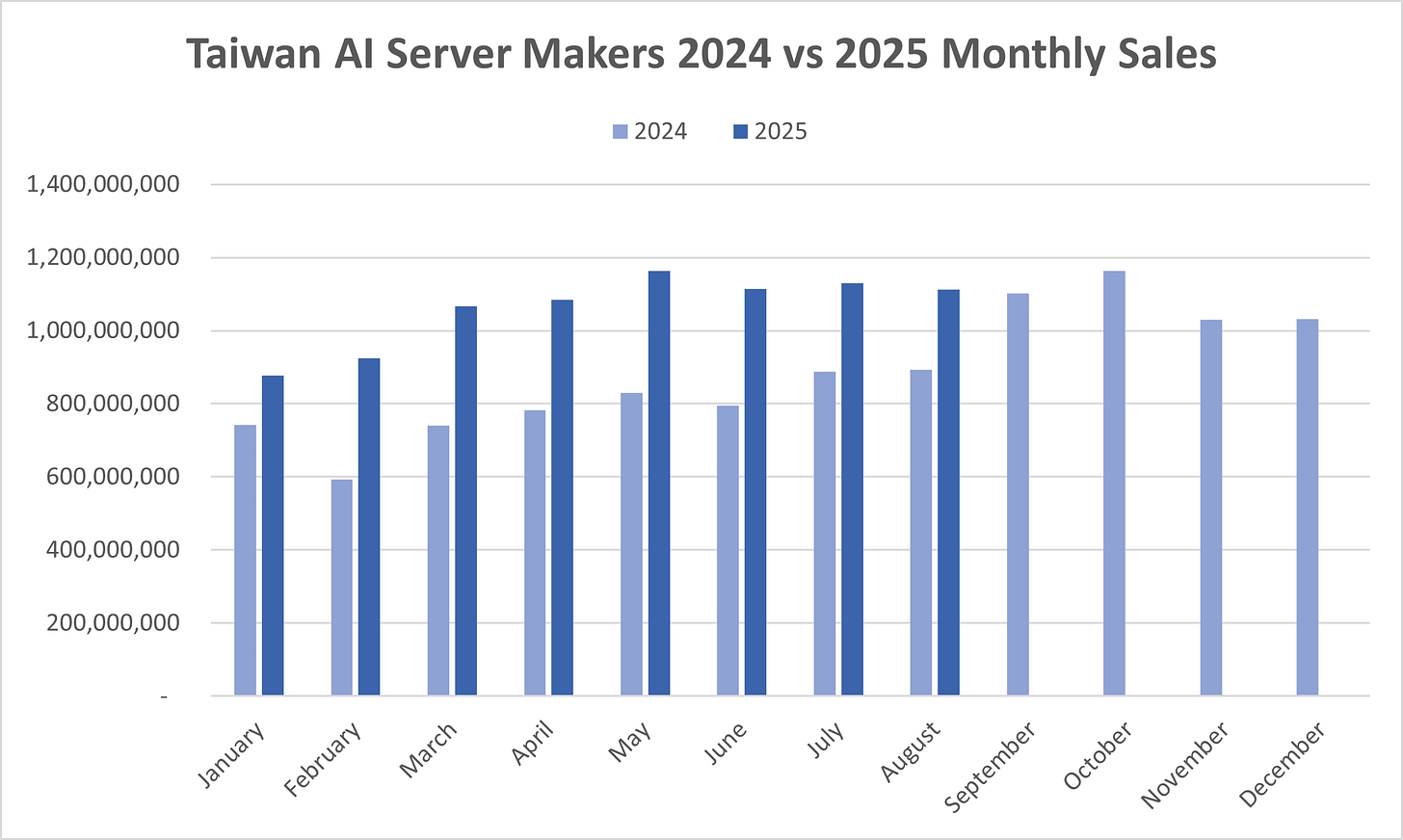

Nvidia’s Pusing Taiwan AI Servers up

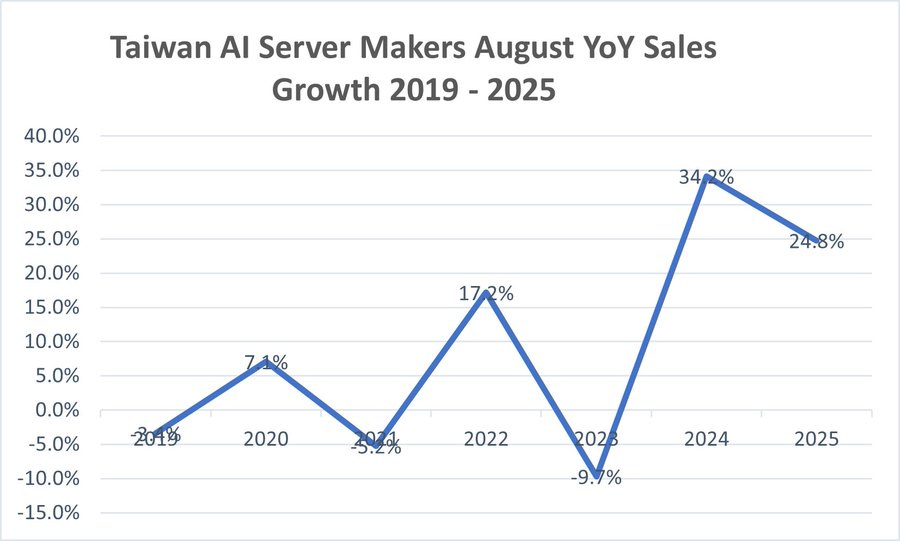

According to Dan Nystedt (an analyst in Taipei), strong demand for Nvidia Blackwell-based AI servers sent August revenue at Taiwan’s ‘Big 6’ makers up a combined 24.8% year-on-year to NT$1.11 trillion (US$36.6 billion).

The real partnership between TSMC and Nvidia are clearly the leaders of this moment. Taiwan’s “Big Six” AI Server companies are accelerating revenue in proportion to the wider market for the demand for compute. Taiwan’s ecosystem is slowly but surely also building around TSMC in Arizona and even in Texas. The U.S. is thus using Taiwan’s prominence in the semiconductor industry to its own benefit.

This Newsletter is a great place to keep track of East Asia semiconductor news, especially with regards to TSMC and Taiwan, our primary focus. So issues related to Taiwan, South Korea, Japan and the U.S. will drive most of our news updates. As I curate this news it also has to do with TSMC’s oversized global role and the number of analysts in Taipei watching this stuff. It’s impossible for me to bring you this news from the point of view of China or the United States, since Taiwan-South Korea and Japan are the key semiconductor supply center of the world as I see it in 2025.