ASML Exception, Samsung & AMD Earnings Beat, Semi Stock Bounce, TSMC to start building Fab in Germany

AI CapEx under review, but NASDAQ powers through. Was there ever really any doubt?

Hello Everyone,

This is an issue for the week up to August 1st, and a lot of interesting Earnings to report. There may be times during the summer or a slow week in news, where I miss a week or two. I’m always watching this stuff, just won’t be publishing as often (July/August).

This is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Support me doing this for as low as $1 a week. Please see my archives for more on what to expect.

Welcome to the 13th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

Analyzing and Curating News 🔔

I’m a news fanatic always analyzing the latest in exponential and emerging tech like robotics, semiconductors & AI chips, quantum, synthetic biology and other fields - as well as BigTech in AI.

When to Expect this Newsletter ⏰

This Newsletter will typically go out on Thursday at 7am Eastern Time (though sorry not today, usually 7 to 9am lately). Posts are partially paywalled and paid subscriptions are cheap.

What? It will attempt to summarize some of the most important news in the semiconductor industry of the last week.

For rundowns: Semiconductor Things

For deep dives: Semiconductor Reports (still in Research mode atm).

Huge News that impacts the likes of ASML, South Korean and Japanese semiconductor industry leaders:

Foreign Direct Product Rule - Foreign Countries Except

President Joe Biden's administration plans to unveil a new rule next month that will expand U.S. powers to stop exports of semiconductor manufacturing equipment from some foreign countries to Chinese chipmakers, two sources familiar with the rule said.

But shipments from allies that export key chipmaking equipment - including Japan, the Netherlands and South Korea - will be excluded, limiting the impact of the rule, said the sources who were not authorized to speak to media and declined to be identified.

The rule, an expansion of what is known as the Foreign Direct Product rule, would bar about half a dozen Chinese semiconductor fabrication factories, or fabs, at the center of China's most sophisticated chipmaking efforts from receiving exports from many countries, according to one of the sources. Read more. This sent Tech stocks surging in the middle of this week. Fairly unusual when the NASDAQ 100 is up 3% in a single day (31st of July, 2024). Meta and Microsoft Earnings also were reinterpreted to be positive for AI CapEx.

Semiconductor Bits & Bites 📱

Nvidia this week sent out the 1st samples of Blackwell-architecture products to clients, media report, citing Jensen Huang at the SIGGRAPH conference. Taiwan media say the release of samples and start of Blackwell-based server assembly will benefit a host of local firms, including Foxconn, Wistron, Wiwynn, Quanta, Inventec, Gigabyte and more.

TSMC in Germany: TSMC will begin construction on its 1st fab in Europe on Aug. 20, with the company’s chairman breaking ground at a ceremony in Dresden, Germany, media report, noting the fab is expect to go into operations in late 2027. Infineon, Robert Bosch and NXP Semiconductor each have a 10% stake in the TSMC fab and are expected to be key customers. The fab is expected to cost over €10 billion euro (US$10.8 billion).

More job cuts at Intel: Intel plans to slash thousands of jobs to reduce costs in an effort to rebound from an earnings slump and market share losses, Bloomberg reports, citing unnamed sources. Intel will report earnings on Thursday (8/1). The company, which employed 124,800 people at the end of 2023, could announce the job cuts as early as this week, according to a report from Bloomberg

ASML shares pop 7% after report that U.S. will exempt allies from new China chip restrictions.

Dutch firm ASML jumped as much as 10% on Wednesday after a Reuters report suggested the company could be exempt from expanded export restrictions on chipmaking gear to China. Meanwhile, Exports to China from countries including Israel, Taiwan, Singapore and Malaysia will be impacted by the U.S. rule, according to Reuters.

Exceptions include: Netherlands, South Korea and Japan.

Big Winners: ASML, SK Hynix, Samsung and others.

Semiconductor Bits & Bites 📱

Samsung Earnings: Samsung Electronics' operating profit rose more than 15-fold in the 2nd quarter to ₩10.44 trillion won (US$7.52 billion), from ₩670 billion a year ago, as memory chip prices rebounded due to the AI boom, Reuters reports. Revenue was ₩74.07 trillion. The company’s chip division (DS Division) posted operating profit of ₩6.45 trillion on revenue of ₩28.56 trillion, driven by HBM, regular DRAM and server SSD sales, Samsung said. Read More into their Earnings.

Both Microsoft and Meta’s Capital Expenditures look significant in AI, but their growth leaving shareholders assured. Microsoft spent $19B on capex in FQ4, up from $14B in FQ3 and $10.7B a year ago. They guided in April for capex to be up "materially" Q/Q in FQ4, but didn't say by how much.

South Korea Exports: South Korea is closing in on Japan in terms of global exports, as South Korea’s exports in the first half of 2024 rose 9% to US$334.8 billion, trailing Japan’s $338.3 billion, which fell 3.6%, media report, noting the gap between the two nations peaked in 2008 and has gradually decreased ever since.

SK Hynix continues to impress: SK Hynix’s exports of SSDs (solid state drives) rose 84% in the 1st half of 2024 to US$501.86 million, from $272.31 million last year, media report, due to a big increase in demand for AI data centers, as SSDs are preferred over traditional hard drives (HDDs) due to better capacity and power efficiency.

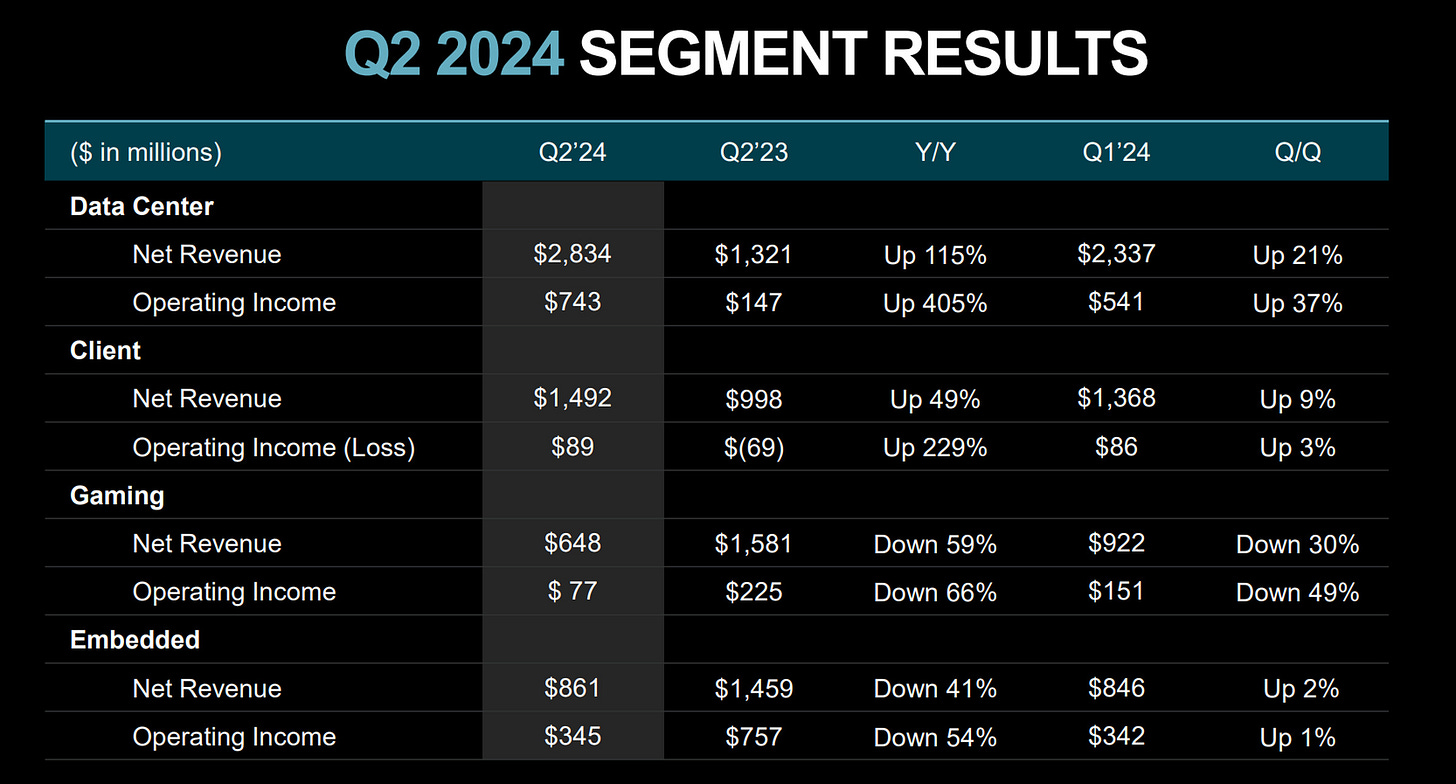

AMD jumps 5% as global chip stocks rally after earnings and geopolitics lift sector

AMD saw strong growth in its data center business, driven by sales of its graphics processing units, or GPUs, which are used to train artificial intelligence models.

AMD’s AI GPU sales just went from a billion dollars cumulatively to a billion dollars quarterly.

The company’s data center business has doubled in a single year, and this quarter’s growth was primarily due to a single chip: the AMD Instinct MI300 accelerator, which competes with Nvidia’s infamously influential H100 AI chip. Read More.