Earthquakes, Intel, SK Hynix Building in Indiana

The crazy pressure of keeping up with AI supercomputers called "Stargates" (basically AI enhanced data centers)

Hey Everyone,

This is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Welcome to the sixth edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

This week we learned a lot more about the ecosystem’s plans for the future.

It turns out even the biggest Earthquake in 25 years can’t slow down Taiwan Semiconductor Manufacturing Company (TSMC). Unfortunately Intel does not look great right now.

Earthquake? No Problem says Taiwan.

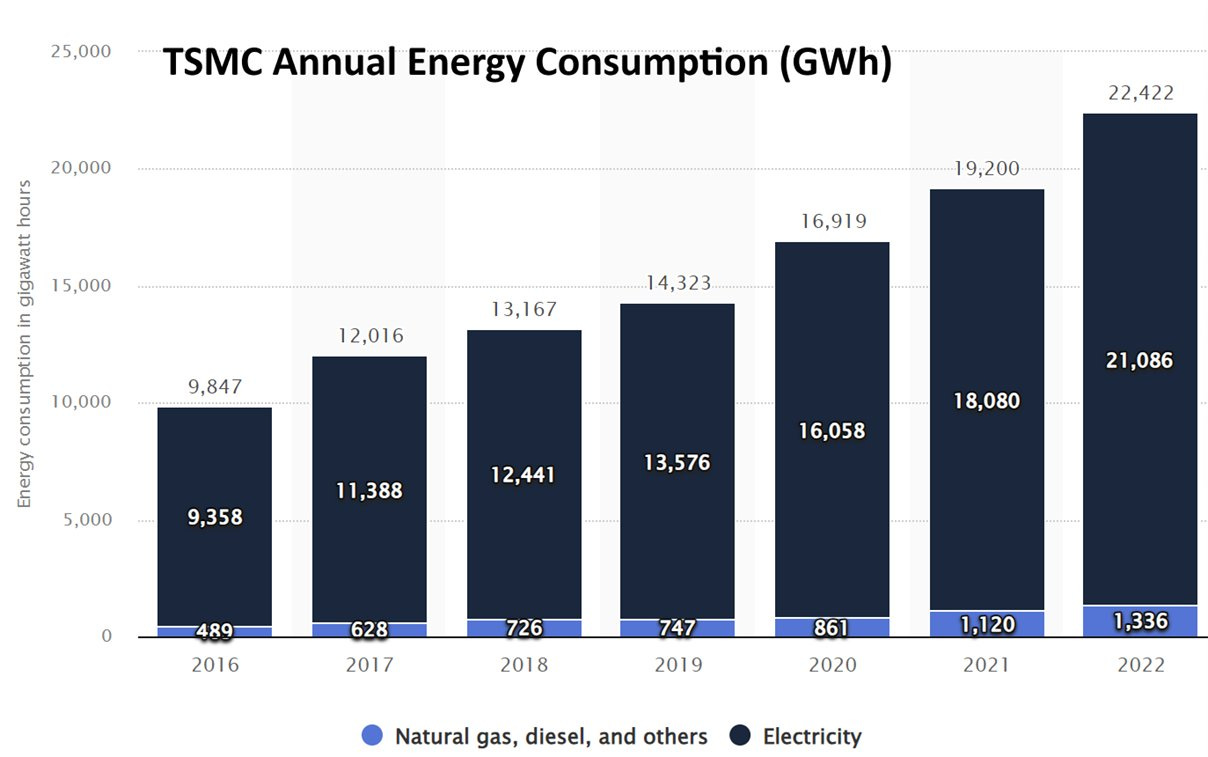

TSMC’s Growing Energy Footprint

Recently Taiwan raised electricity prices. On March 22nd it was announced, Taiwan will raise electricity prices by an average of 11% starting from April 1 including a 25% increase for large industrial users to help arrest losses for the island's state-run power firm, the economy ministry said on Friday.

Intel’s Huge Operating Loss Revealed for 2023

Intel on Tuesday revealed an operating loss of $7 billion in 2023. It was the first time Intel had reported revenue totals for its foundry arm alone, separating it from the products business.

They reported $11.3 billion in operating income in 2023. Their stock is down over 15% in 2024 alone. Intel said Tuesday that it expects its foundry losses to peak in 2024 and break even halfway between the current quarter and the end of 2030. The market isn’t buying it.

Ironically, about one-third of Intel's products are now made by the company's foundry partners, mainly TSMC.

SK Hynix is the Most important Company you’ve never Heard of

SK hynix Inc. is a South Korean supplier of dynamic random-access memory chips and flash memory chips. Hynix is the world's second-largest memory chipmaker and the world's sixth-largest semiconductor company.

They are a key Nvidia supplier and now plans to invest $3.87 billion in U.S. chip facility. The project includes a packaging fabrication and R&D facility for SK Hynix’s next-generation AI chip products. Location? West Lafayette, Indiana of all places. If you know the region, that’s near Purdue University.

SK Hynix said the facility, slated for operation in 2028, will house a production line for SK Hynix’s cutting-edge high-bandwidth memory chips — important components in the Nvidia GPUs used to train AI system.

SK Hynix is now the 2nd biggest company in South Korea by market value, trailing only rival Samsung Electronics. SK Hynix’s market capitalization surged past US$100 billion, more than doubling over the past year, as investors buy into companies seen as key providers of AI technology, Bloomberg reports.

The Generative AI era is having a fascinating impact on semiconductor firm valuations in 2023-2024. I wonder if it’s sustainable?

AMD Heralds Custom multi-chiplet designs

AMD says the UCIe universal chiplet interface will create a whole ecosystem — custom multi-chiplet designs are the future.

AMD pushes UCIe open chiplet spec to foster custom designs – Board members include Alibaba, Intel, Nvidia, TSMC, and Samsung.

For modular multichiplet designs, a high-performance, low-latency, and low-power interface is a must. The Infinity Fabric interface enabled AMD to build unique EPYC, Ryzen, and now Instinct MI300-series processors with unrivaled core counts, performance, and feature sets, Naffziger explained in a YouTube video conversation with Mark Papermaster, AMD's chief technology officer.

Semiconductor Bits & Bites 📱

I call Dan the Chip whisperer, crazy what you can notice when you are based out of Taiwan. What’s on the menu Dan? Well there was an Earthquake Mike… (yeah I barely felt it).

Analysts expect Taiwan's 4/3 earthquake to boost DRAM memory chip prices, as Taiwan accounts for around 15% of the global supply, Barron’s reports, noting Micron Technology operates a few fabs and a chip packaging facility there.

Nvidia says it does not expect any supply chain disruptions from the Taiwan earthquake, Reuters reports. “After consulting with our manufacturing partners, we don’t expect any impact on our supply from the Taiwan earthquake," Nvidia reportedly said in a statement.

Samsung will likely post its biggest profit in 6-quarters on higher memory chip prices when it reports preliminary 1st quarter results Friday (4/5), Reuters reports. Operating profit likely rose 9-fold to ₩5.7 trillion won (US$4.24 billion), the consensus estimate from 27 analysts, compared to ₩640 billion a year ago.

SK Hynix and specialty gas provider, TEMC, have developed neon gas recycling technology, a first for the semiconductor industry, media report, adding SK Hynix expects to save up to 40 billion won (US$30 million) a year by reducing reliance on imports. Russia’s war on Ukraine, the biggest neon gas maker, has caused production to fall and prices to rise.

SK Hynix’s market capitalization surged past US$100 billion, more than doubling over the past year, as investors buy into companies seen as key providers of AI technology, Bloomberg reports, noting heavy demand for its HBM (high bandwidth memory) chips. SK Hynix is now the 2nd biggest company in South Korea by market value, trailing only rival Samsung Electronics, which has a market value over $360 billion, but “has lagged SK Hynix in developing memory chips for AI.”

Samsung Electronics plans to unveil 3D DRAM chips in 2025 in a bid to lead the global AI memory chip market, which is currently dominated by smaller rival SK Hynix, media report, noting the basic capacity of 3D DRAM is 100GB, nearly triple the 36GB maximum capacity of current DRAM.

Strong demand for AI servers globally will see Taiwan’s server sales rise 15% this year, media report, citing DigiTimes Research. Last year, server sales fell 7% in part due to weak demand for traditional servers. The top 2 server makers in Taiwan last year were Foxconn and Wistron. Foxconn’s server sales fell 9.2% year-on-year to NT$851.0 billion last year, but are expected to grow 15% this year. Wistron’s server sales fell 5.2% last year to NT$614.3 billion, and are expected to grow significantly this year.

Keep reading with a 7-day free trial

Subscribe to Semiconductor Things™ to keep reading this post and get 7 days of free access to the full post archives.