Intel CHIPS Act Grants, Nvidia Rival, China Ban Whirlwinds for Semiconductor Industry

And, the coalition plot to challenge Nvidia (which also involves Intel)

Hey Everyone,

This is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Welcome to the fifth edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

It’s been a fairly eventful week in the Semiconductor and AI Chip ecosystems.

Intel’s Massive Grant and Loan

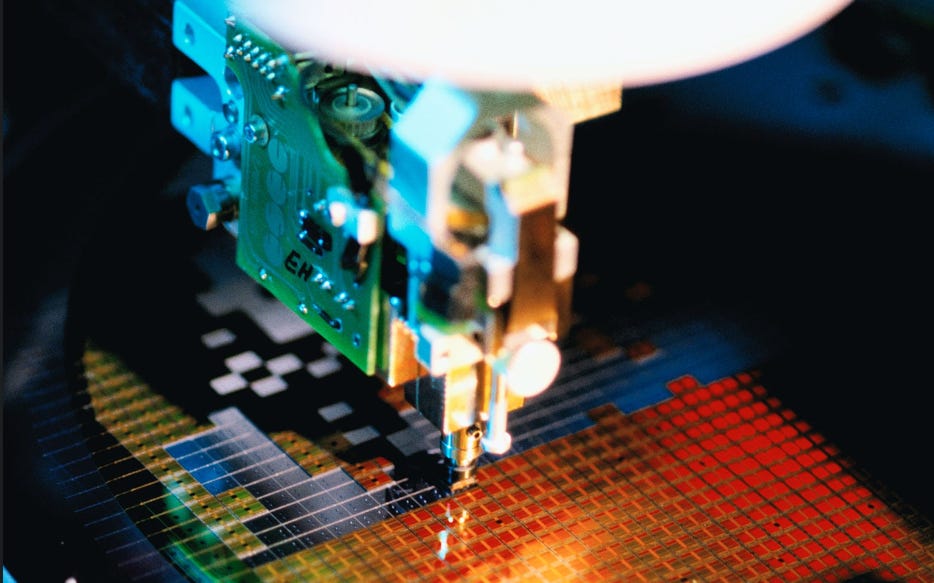

Intel is in line to receive as much as $8.5 billion in direct funding from the federal government as part of the CHIPS Act, it was revealed in late March, 2024. The company could also receive up to $11 billion in loans tied to the legislation, which was passed in 2022.

But will it even make a material difference for Intel, which seems on the decline in recent years? The money will help “leading-edge semiconductors made in the United States” keep “America in the driver’s seat of innovation,” U.S. Secretary of Commerce Gina Raimondo said on a call with reporters. Intel and the White House said their agreement is nonbinding and preliminary and could change. While the U.S. tries to make Intel a National champion, China is responding to AI chip bans.

China Blocking Intel and AMD chips in Government Equipment

China introduced new guidelines aimed at blocking Intel and AMD chips in government PCs and servers, the Financial Times reported on Sunday. China has been boosting its domestic semiconductor industry as it seeks to reduce reliance on foreign technology. Huawei and SMIC among others are seeking to grow China’s internal semiconductor industry now also using the “National security” card with new bans. Intel makes up to 27% of its revenue from China. AMD drew about 15% of its sales from the country.

The AI chip bans to China hurt Nvidia the most though in terms of demand for H100s. The country accounted for just a mid-single-digit percentage of its data center chip revenue, the company said, down from 19% in fiscal year 2023.

The Plot to take down Nvidia

It sounds like some semiconductor and monopoly players in BigTech aren’t too happy about Nvidia’s rise to power. A new coalition of tech companies that includes Qualcomm, Google and Intel plans to loosen Nvidia’s chokehold by going after the chip giant’s secret weapon: the software that keeps developers tied to Nvidia chips. They are part of an expanding group of financiers and companies hacking away at Nvidia's dominance in AI.

Starting with a piece of technology developed by Intel called OneAPI, the UXL Foundation, a consortium of tech companies, plans to build a suite of software and tools that will be able to power multiple types of AI accelerator chips. This along with BigTech companies trying to make their own AI chips in-house or trying to side with AMD on a possible alternative to Nvidia AI chips.

This is not even counting the antics by Sam Altman luring the UAE and Softbank’s Masayoshi Son with a credible AI chip ambition that can further leverage ARM. The Wall Street Journal reported in February, 2024 that OpenAI CEO Sam Altman is in talks with investors to raise as much as $5 trillion to $7 trillion for AI chip manufacturing. It’s all so absurd when you begin to understand how Nvidia is like the AWS of AI chips already.

TechCrunch postulates how Nvidia is actually a first-mover in a very unique way. Nvidia’s genius was the fact that the GPU, created for gaming purposes, was also well suited to processing AI workloads. Now Nvidia is developing into an Emerging Tech Cloud leader and a long train of significant partnerships leading actual innovation.

Intel is seeking to make the U.S. relevant again in the semiconductor industry, but I’m not sure grants or loans to it are well spent. CHIPS Act funding aims to increase U.S. semiconductor manufacturing and research and development capabilities, especially in leading-edge semiconductors. Intel is the only American company that both designs and manufactures leading-edge logic chips. The CHIPS Act itself has been extremely slow, inefficient and poorly set up.

Government agencies higher the township level have been ordered to purchase “safe and reliable” processors and operating systems, FT said. Apparently for China, Intel and AMD don’t fall in that category.

Last year, in 2023, China generated 27% of Intel's sales, earning $54 Billion, while AMD enjoyed $23 Billion in sales, according to reporting from the Financial Times.

Will Intel and AMD fall in that category of companies struggling due to declining sales in China like Apple and Tesla? Given how important the Chinese market still is, it’s a major curse just as Intel was set to receive a significant chunk of the CHIPS Act on Fabs that are likely to be years behind TSMC and Samsung.

Intel CEO Pat Gelsinger said that despite China's progress in the chipmaking industry, its technology will stay behind by ten years in the foreseeable future. In 2024, I have more faith in China’s ability to innovate than I do faith in Intel’s ability to catch up to the global leaders like TSMC.

Let’s focus on the round-up of some of the latest Semiconductor Things News:

Semiconductor Bits & Bites 📱

I call Dan the Chip whisperer, crazy what you can notice when you are based out of Taiwan. TSMC is the center of the world in this territory.

How Taiwan could benefit: A move by China to replace Intel and AMD CPUs in PCs at government offices and state-backed firms could benefit Taiwan’s Via Technologies and RDC Semiconductor, which both make x86 compatible CPUs

TSMC orders from Apple, Intel and AMD for 3nm production will increase quarter-by-quarter all year to account for over 20% of total revenue, putting 3nm second behind only 5nm for TSMC revenue, according to media reports.

Samsung Electronics is actively seeking M&As, with the tech giant circling a deal to buy part of the automotive electronics business of Germany’s Continental, media report, as well as bidding for Johnson Controls’ HVAC unit, in a deal that would also include Johnson’s 60% stake in Johnson Controls-Hitachi Air Conditioning.