Nvidia Earnings, AMD Acquisition, China Export Controls New Signs, Samsung to Spin Foundry, Jensen on China loss, Trump's Illegal trade wars.

Trade madness illegal - but Trump's show goes on.

Hey Everyone,

Here are the semiconductor news highlights of the past three weeks.

It’s a crazy time again as The United States has ordered a broad swathe of companies to stop shipping goods to China without a license and revoked licenses already granted to certain suppliers. Products affected include design software and chemicals for semiconductors, butane and ethane, machine tools, and aviation equipment. Read the details (Bloomberg).

The United States will “aggressively” revoke visas for Chinese students studying in the U.S., including those with ties to the CCP or studying in critical fields, according to United States Secretary of State Marco Rubio.

Let’s first take a serious snapshot of Nvidia’s Earnings:

Nvidia Earnings

Nvidia’s earnings were very important for validation that demand is still great for AI chips. I believe the CEO covers this fairly well in the video below.

Highlights

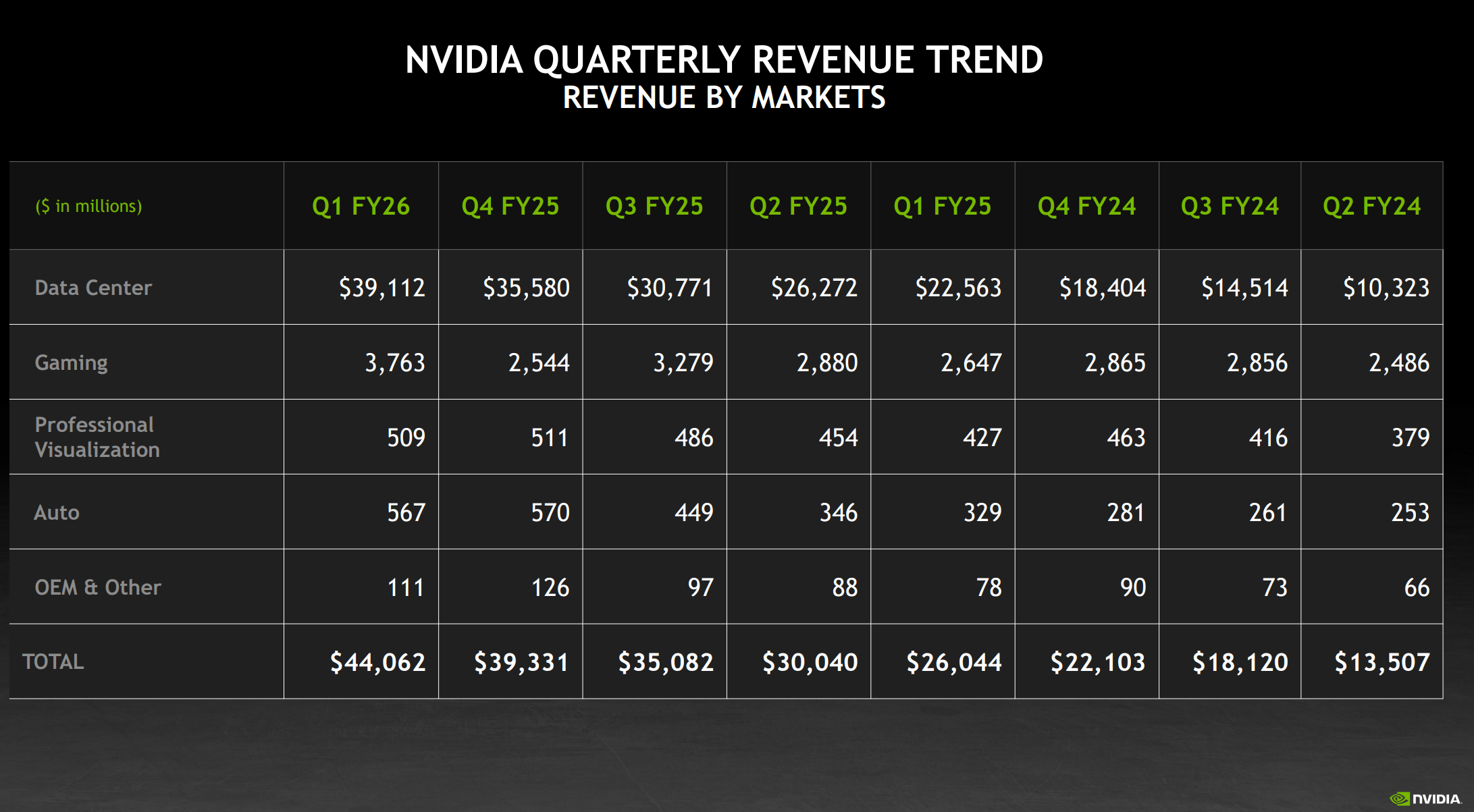

Nvidia’s data center business recorded year-over-year growth above 73%.

Overall revenue grew 69% during the quarter

Sales in the company’s data center division, which includes AI chips and related parts, grew 73%.

Guidance is not stellar: Nvidia said it expects about $45 billion in sales in the current quarter, versus LSEG estimates of $45.9 billion in sales in the July quarter.

Nvidia CEO Jensen Huang told investors on an earnings call that the $50 billion market in China for AI chips is “effectively closed to U.S. industry.” Where they will write off around $8 Billion.

Nvidia reported $26 billion in the same period last year. This year they reported $44.1 billion for the quarter, for a 69% YOY raise.

Net income increased 26% to $18.8 billion.

I expect the stock to be up between 5-6% today. NVDA 0.00%↑, Earnings went live AH yesterday.

The company’s automotive and robotics division reported sales growth of 72% to $567 million.

On April 9, 2025, NVIDIA was informed by the U.S. government that a license is required for exports of its H20 products into the China market. As a result of these new requirements, NVIDIA incurred a $4.5 billion charge in the first quarter of fiscal 2026 associated with H20 excess inventory and purchase obligations as the demand for H20 diminished. The China loss appear fairly serious.

Reasoning Models and Inference Demand Revolution

Jensen sounded very optimistic post Earnings this week.

Nvidia said it spent $14.1 billion on share repurchases during the quarter and paid $244 million in dividends.

Nvidia CEO Interview (CNBC)

This is my favorite recent interview by Jensen Huang.