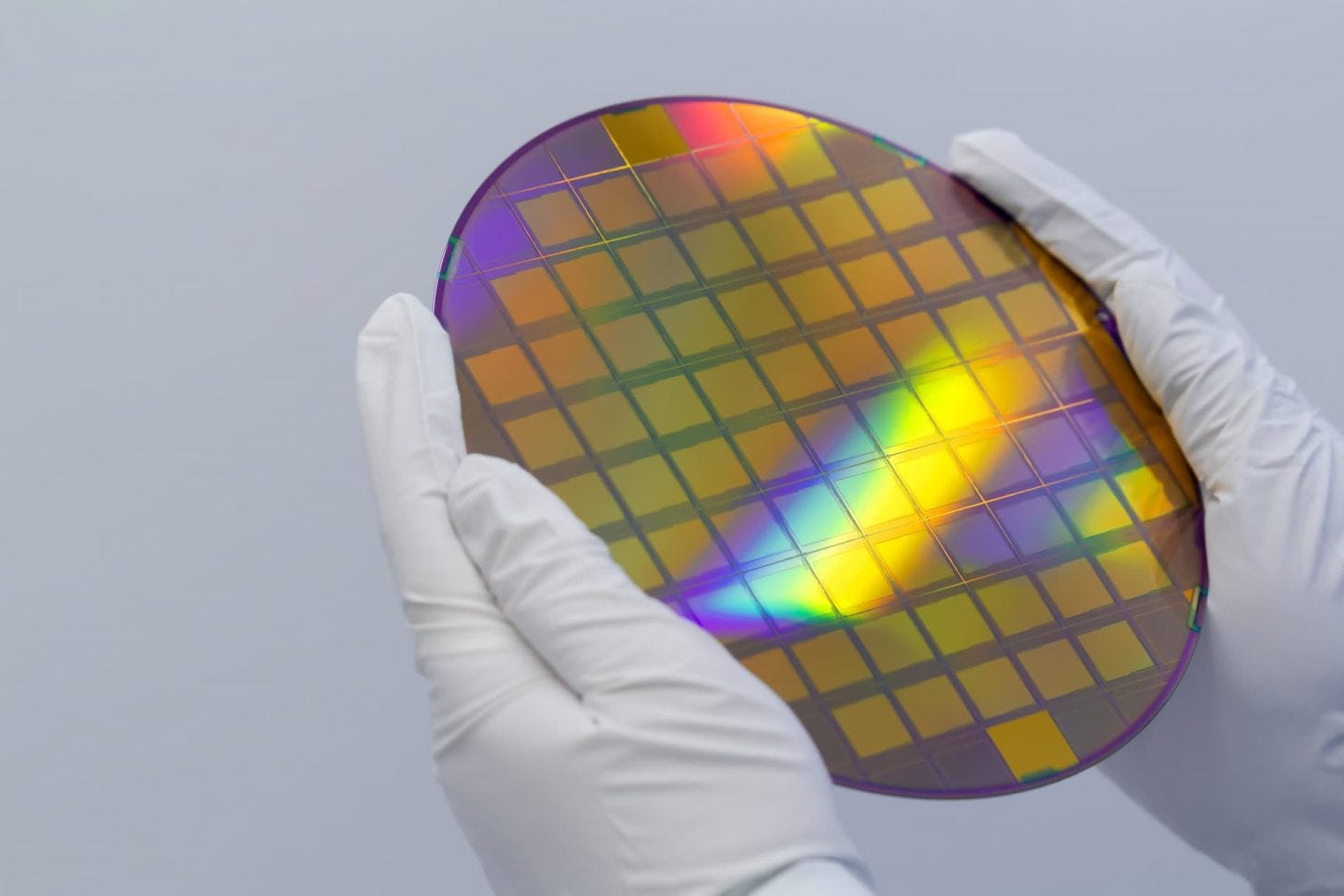

Nvidia Earnings, TSMC's global expansion, Taiwan's semiconductor Supremacy lifts all boats ⛵

Taiwan's role in the picks and shovels of AI cannot be overestimated. 🇹🇼

I hope you had a good summer, this Newsletter is back to its regular cadence of about 2-3 times a month.

I went into some details about Nvidia’s Earnings here.

To read our last issues go here.

My intent is to catch you up on the major Semiconductor News via curation from Twitter and other sources.

I currently live in Taiwan (near Taichung) so much of this is from the perspective of semiconductor news as it relates to Taiwan, South Korea and Japan and to a lesser extent the United States.

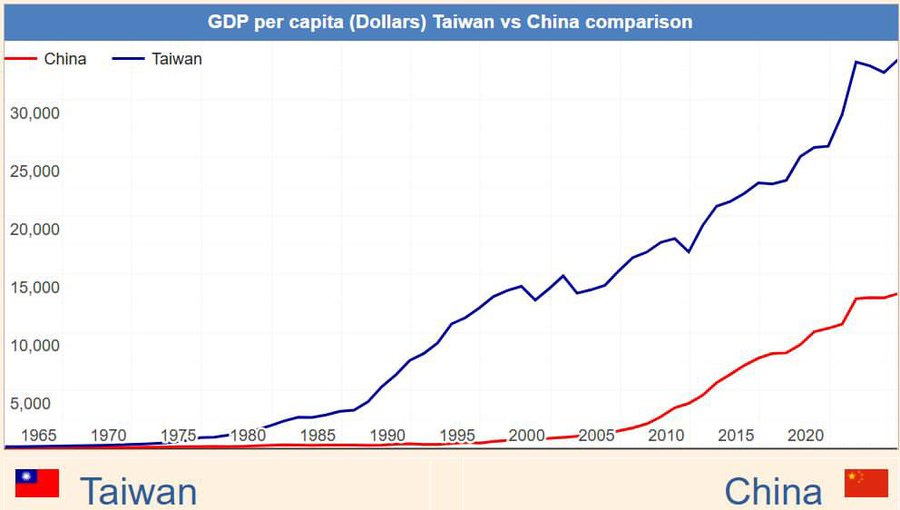

TSMC’s ecosystem is lifting Taiwan’s GDP during the AI boom in the 2020s like few times in history:

Part of the mandate of this Newsletter is also to highlight TSMC’s and Taiwan’s unique role in the global semiconductor supply chain. Too often this is taken for granted. Much of this Newsletter is bullet points of notable events that took place in August, 2025.

Speaking of which this August - TSMC founder Morris Chang arrived in Taiwan 40-years ago (8/18/1985) and began his journey to build TSMC into the world’s biggest chip maker, media report, calling it a “Date with Destiny”. Chang was originally hired to lead the government-led R&D institute (ITRI), but within 2-weeks, officials proposed he build a semiconductor company. The rest is history.

TSMC’s global push in the 2020s is also going to be formidable. For instance, Taiwan will set up a task force on the potential of setting up science parks (industrial parks) overseas, including in India, USA, Mexico, Poland, to help local companies expand abroad, media report, citing Taiwan’s economics minister, who said Taiwan’s financial institutions are willing to provide support. The task force will work with local industry groups, including TEEMA, which is led by Foxconn Chairman Young Liu.

Shall we begin?

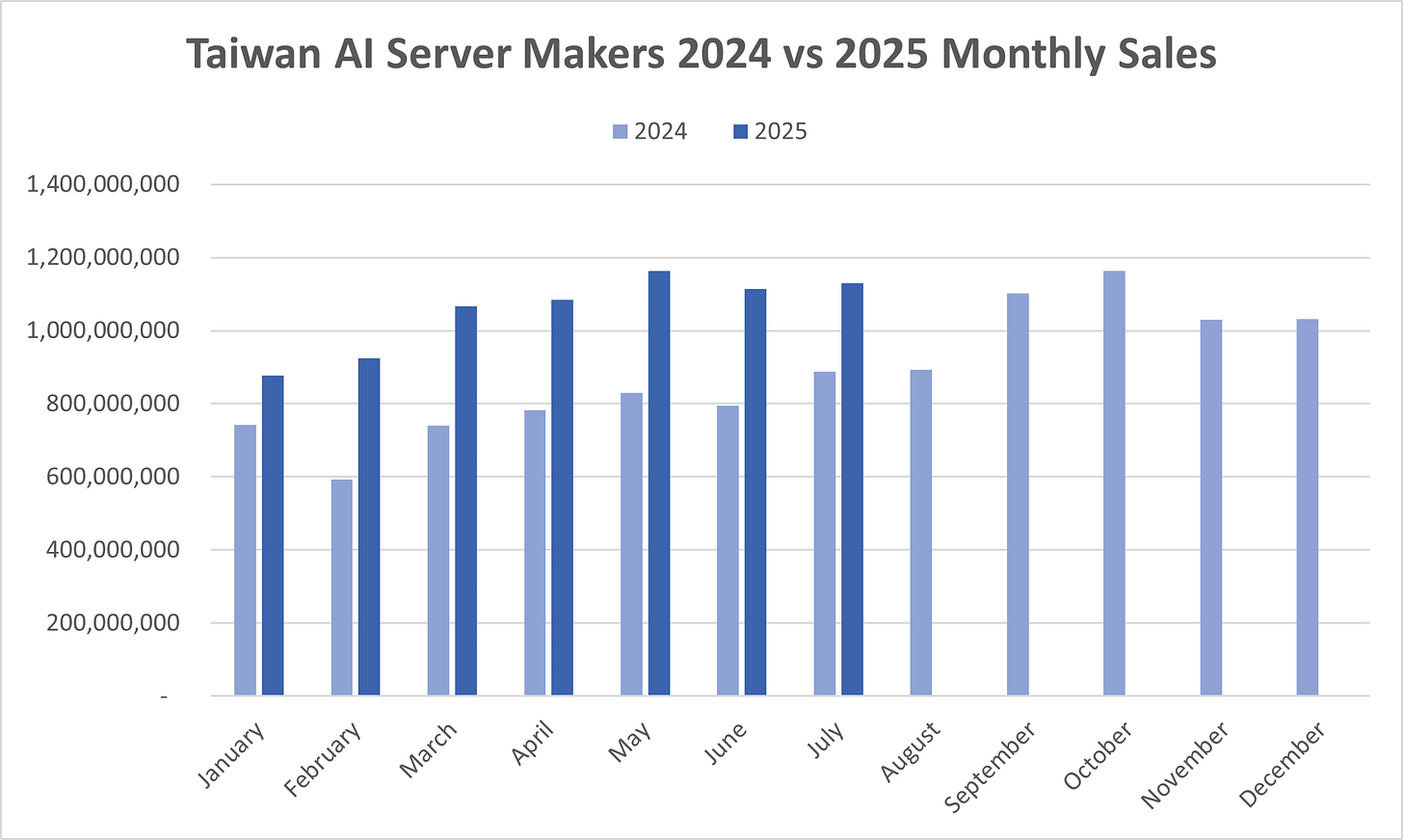

Taiwan’s AI Server Makers are Surging on Blackwell demand

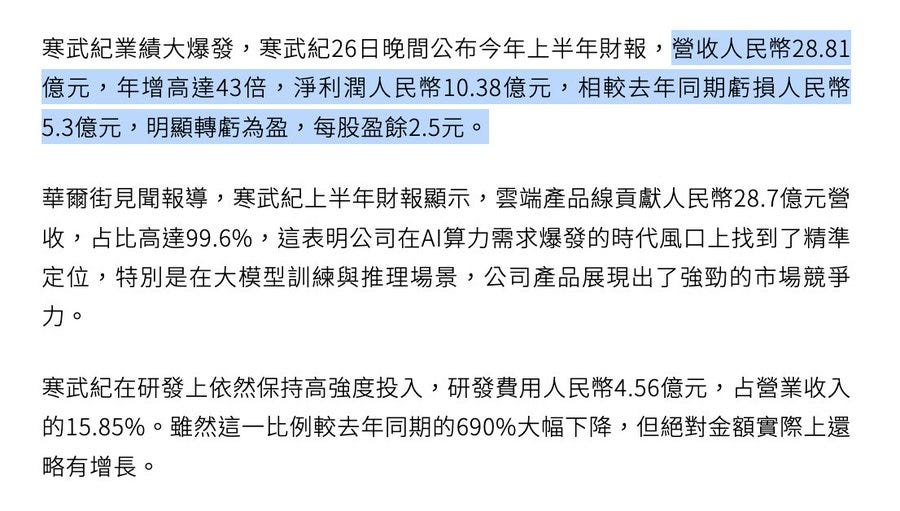

The Cambricon Attack

Chinese No.2 AI chipmaker Cambricon's revenue reached RMB 2.881 billion, a YoY increase of 43 times.

Cambricon's revenue climbed over 4,000% year over year to 2.88 billion Chinese yuan ($402.7 million) in the first half of 2025, with net profit reaching a record 1.04 billion yuan. Read more.

Today’s issue really is like a crash course in TSMC’s impact and news, even more so than usual. Also a lot of global diversification. Japan investing in India, South Korea investing in the U.S. and a lot of big moves like that. The compute demand is lifting a lot of Taiwanese companies around TSMC, and it’s like few other things happening in the industry.

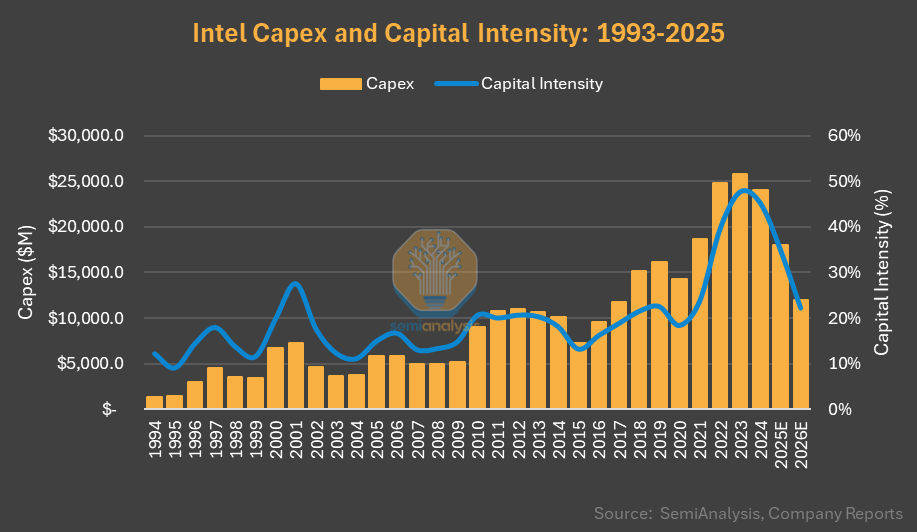

For you history buffs - Between 1994 and 2019, only twice Intel spent less capex than TSMC. But from 2020, TSMC consistently outspent Intel. In 2025 alone, TSMC will spend $22B more capex than Intel. However, 47% of Intel's 2025 capex is offset by subsidies, partners (Apollo, Brookfield) and customer payments.

We had a lot of earnings news too in August, so sort of a massive article.

🌍 Semiconductor Bits & Bites 📱