TSMC Earnings, ASML Woes, Nvidia's Blackwell Demand, Meta's Weird Datacenter Overhaul

TSMC is the real picks and shovels of Generative AI, not Nvidia. Intel vs. Nvidia, stars fade and rise.

Today’s issue is very image heavy so ideally read on a web browser on a computer, not mobile.

Blackwell system with GB200-powered AI servers

Hello Everyone,

Welcome to the 18th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

This Newsletter explores TSMC, Taiwan and Nvidia in particular. Earnings are a lot of what I want to cover on an on-going basis.

I’m convinced that in 2024 watching the AI chips and Semiconductor space is actually the most interesting it’s been in decades.

Support me doing this for as low as $1 a week. Please see my archives for more on what to expect.

Typically now the Newsletters comes out two or three times a month, usually around Thursday morning (ideally at 7 AM EST). Functionally often a bit late.

The Newsletter is mostly concerned with micro events in the semiconductor News cycle.

As 🌟 one star falls, another takes its place - Intel vs. Nvidia.

The 2020s are another kind of beast. 🐲

Watch the short video:

In the headlines:

Taiwan Semiconductor Manufacturing Co. raised its target for 2024 revenue growth after quarterly results beat estimates, allaying concerns about global chip demand and the sustainability of an AI hardware boom.

Read my recent State of AI report summary on AI Supremacy 🗿.

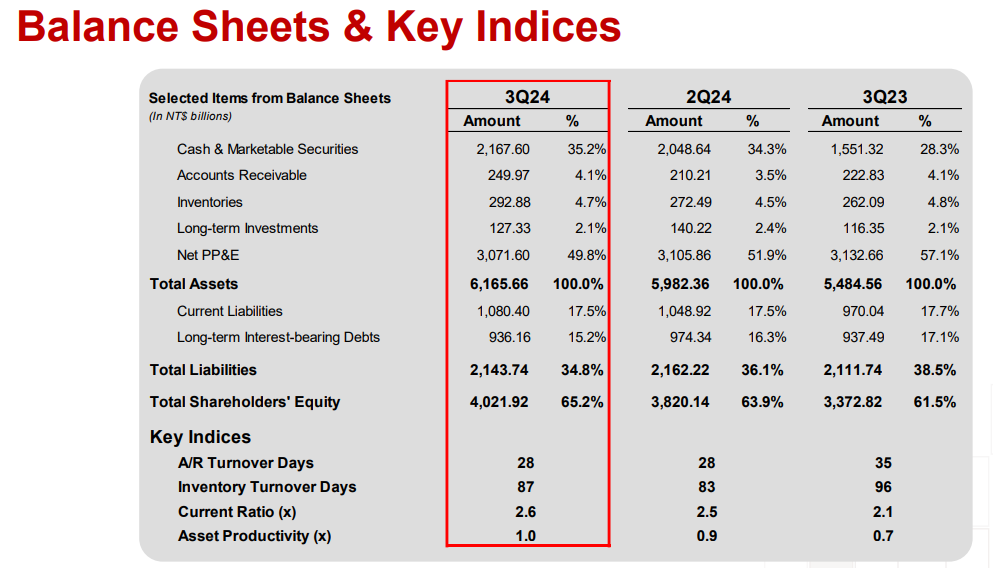

TMSC Q3 2024 Earnings

Fresh off the press, TSMC Earnings net revenue came in at $23.5 billion in the third quarter, up 36% year-on-year, with TSMC’s gross margin rising to 57.8% over July-September, compared with 54.3% in the same period of last year.

The company’s net income was 325.3 billion Taiwanese dollars ($10.1 billion) over the July-September quarter.

Revenue for Q3 was NT$759.69 billion (US$23.50 billion)

This means net revenue was up up 36% year-on-year YOY.

TSMC is the world’s largest producer of advanced chips, serving clients such as Nvidia and Apple. It is the real picks and shovels company supporting the entire ecosystem.

Bullish Earnings Call

In the Thursday earnings call, TSMC Chairman and CEO C.C. Wei stressed that AI demand is “real” and that the company has experienced the “deepest and widest growth of anyone in this industry,” as a result.

Oddly ASML stunned markets by reporting about half the orders investors had expected, more on that later (China may be related).

TSMC now anticipates its capital expenditure for this year will pick up to slightly higher than $30 billion, it said during its earnings call. CFO Wendell Huang said fourth quarter revenue will be between $26.1 billion and $26.9 billion, with a gross margin of 57% and 59%, while annual revenue is also expected to grow around 30%.

There are few winners in the entire Generative AI market quite like Nvidia, TSMC, OpenAI and some of the related companies in the semiconductor supply chain. This makes watching the AI chips and Semiconductor space the most interesting it’s been in decades.

Read the Earnings Deck.

🌍 Semiconductor Bits & Bites 📱

🌸 South Korea in battle mode. South Korea will inject an additional ₩8.8 trillion won (US$6.45 billion) into its semiconductor industry next year via low-interest loans, infrastructure and training, media report, noting the plan follows the ₩26 trillion package unveiled in May. Of the new funds, ₩4.7 trillion is for low cost loans, while ₩2.4 trillion will be for infrastructure at a semiconductor industrial park in Yongin, Gyeonggi Province.

Intel in trouble in China? The Cyber Security Association of China called for an investigation of Intel to protect consumers, accusing the US chip maker of allowing built-in backdoors in chips, compromising user safety, media report, adding the agency is backed by the powerful Cyberspace Administration of China. While CSAC is an industry group rather than a government body, it has close ties to the Chinese state and the raft of accusations against Intel, published in a long post on its official WeChat account, could trigger a security review from China's powerful cyberspace regulator, the Cyberspace Administration of China (CAC). Read available details.

Taiwanese companies are raising the most money in almost two decades as chipmakers embark on expansion plans to meet growing demand for artificial intelligence components. Read more.