TSMC nears $1 Trillion market cap, 👑 Nvidia on top of the world, AI valley of semiconductors takes shape 2023-2030.

The new AI datacenter world emerges.

Hello Everyone,

This is an issue for the weeks catching up to the present time so most of June, 2024. There may be times during the summer or a slow week in news, where I miss a week or two. I’m always watching this stuff, just won’t be publishing as often (June/July).

This is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Support me doing this for as low as $1 a week.

Welcome to the 12th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

Analyzing and Curating News 🔔

I’m a news fanatic always analyzing the latest in exponential and emerging tech like robotics, semiconductors & AI chips, quantum, synthetic biology and other fields - as well as BigTech in AI.

When to Expect this Newsletter ⏰

This Newsletter will typically go out on Thursday at 7am Eastern Time. Posts are partially paywalled and paid subscriptions are cheap.

What? It will attempt to summarize some of the most important news in the semiconductor industry of the last week.

For rundowns: Semiconductor Things

For deep dives: Semiconductor Reports

We have a lot of catching up to do, so let’s get into it:

Semiconductor Bits & Bites 📱

I call Dan the Chip whisperer, crazy what you can notice when you are based out of Taiwan. TSMC is the center of the world in this territory.

Nvidia Overtakes Microsoft, TSMC nears $1 Trillion Valuation

It’s rare for a company outside of the U.S. to hit $1 Trillion market cap but Taiwan’s TSMC has done on it the back of Nvidia’s incredible run. It’s hard to even quantify. Driven by booming demand for artificial intelligence (AI) technology, Taiwan Semiconductor Manufacturing Co. (TSMC) saw its market capitalization jump to US$931.90 billion on Tuesday, making it the world's eighth most valuable company.

NVIDIA CEO Jensen Huang says that the company's $100 billion revenue mostly manufactured in Taiwan, adds how AI has helped Taiwan and Taiwanese companies.

China Continues to Frantically Innovate and Built Workarounds

One of the challenges faced by the Chinese chip design industry is the lack of advanced domestic electronic design automation (EDA) tools. Market leaders Cadence and Synopsys are unable to supply the chipmaking software to Chinese entities due to U.S. export controls. However, China's EDA platform can now run on Arm-based and SPARC v9-based CPUs. Recently, a Chinese firm, Xinhuazhang, introduced its first EDA software that can work on China's domestically produced processors. Read more.

As semiconductors and the GPU industry becomes more important, dozens of new Newsletters are taking shape and people like Dan Nystedt who curate the news are becoming more important as well as many journalists in Taiwan itself. It’s’ looking like in June, 2024 the Nvidia frenzy is spilling over to TSMC now. In Taiwan, $TSMC as stock is up only 65% year to date. On the NY stock exchange however TSM 0.00%↑ it’s 77%. Not a bad year for TSMC in 2024. The news on the ground is even more bullish.

Semiconductor Bits & Bites 📱

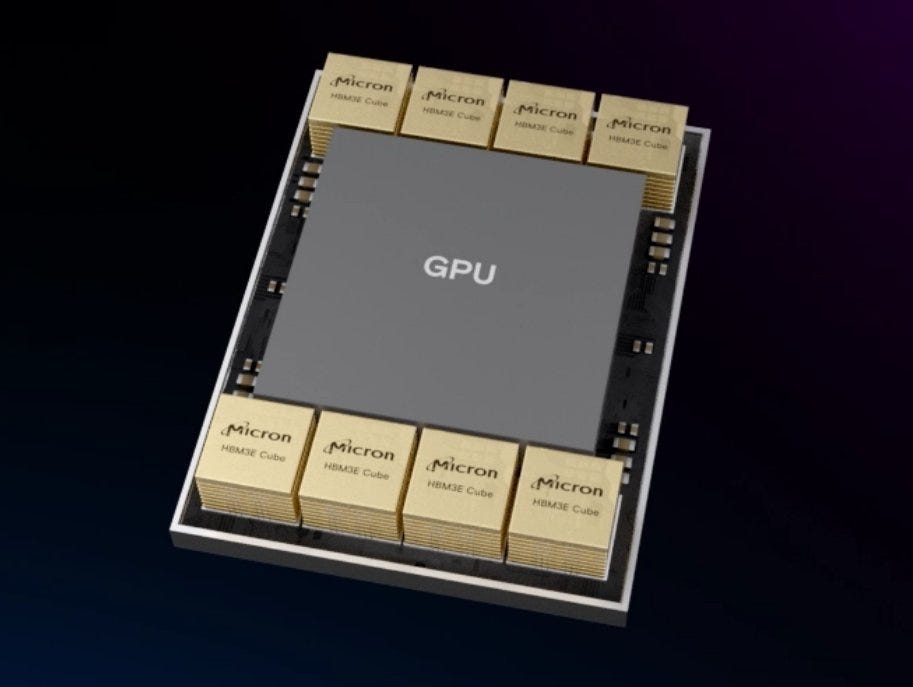

Nvidia has yet to sign on with Samsung for HBM (high bandwidth memory) chips, a problem that will eventually be resolved by Nvidia’s need for Samsung’s silicon interposers and advanced chip packaging, The Elec reports, noting the bottleneck for Nvidia H100 and H200 systems now is a shortage of TSMC CoWoS packaging capacity, while an interposer shortage looms.

The interposer integrates multiple chips into one package, Nvidia GPUs + HBM memory chips, etc. They are big. The H100’s interposer is 3.3x the size of a lithography mask. Only 9 can be cut from a 12-inch silicon wafer (40nm process). More advanced GPUs are even bigger, and by 2026 will need interposers 5.5x the size of a mask, and in 2027, 8x. TSMC is working on CoWoS-L, (local interconnect) to shrink the interposer, but it’s difficult. The Elec argues Nvidia will eventually need help from Samsung.

To make this a bit easier to read, let’s not only focus chronologically but regionally:

News from the U.S.

US chipmaker Onsemi plans to invest US$2 billion to expand semiconductor production in the Czech Republic for power management chips used in AI data centers, electric vehicles, more, media report. Onsemi will add advanced packaging to the site, already home to a silicon and silicon carbide (SiC) wafer manufacturing plant and a silicon wafer fab. Onsemi is in talks for EU subsidies.

Rumor: Apple is working on a more affordable version of the Vision Pro headset, with fewer features, to be released next year, and may cease development of the current model, media report, adding Taiwan’s Foxconn would be manufacturing partner for the new headset, not current supplier LuxShare (China).

Micron Technology is expanding production of HBM (high bandwidth memory) chips by building test production lines in the USA, expanding capacity in Taiwan and considering making HBM in Malaysia, Nikkei reports, noting the US memory chip maker’s biggest HBM site globally is in Taichung, Taiwan. Micron aims to triple its market share of HBM, the AI memory chip, to the ‘mid-20’ percent range by 2025.

Softbank Expected to make big bets on AI chips and Generative AI soon

Japanese conglomerate is on the cusp of making a major investment in AI. Bloomberg is reporting Masayoshi Son is on the move.

“We need to look for our next big move, without fear of whether it’ll be a hit or miss,” Son told SoftBank Corp. shareholders gathered for the wireless operator’s annual meeting. He added that the company lost billions of dollars through its bet on WeWork. “SoftBank Group’s dynamism arises from looking for new seeds of evolution, especially abroad.”

Softbank controlled ARM is set to release its own AI chip product in late 2025. U.K.-based Arm will set up an AI chip division, aiming to build a prototype by spring 2025. Mass production, to be handled by contract manufacturers, is expected to start in the fall of that year.

Sofbank could be major players soon in the AI chip business, funding Generative AI startups and funding the Energy investments to keep up with demand from datacenters and AI GPU gigafactories. SoftBank will also ramp up its renewable power generation business to help supply generative AI’s power needs, especially in the US, Son also said. Read More.

Semiconductor Bits & Bites 📱

GlobalWafers’ (Taiwan) subsidiary, MEMC S.p.A, has been granted €103 million (US$111 million) in subsidies from Italy for a new factory there that will be Europe’s most advanced 12-inch semiconductor wafer-making plant once completed, media report, strengthening Europe’s chip supply chain.

Intel is moving aggressively on silicon photonics and CPO (co-packaged optics), joining hands with Taiwan’s LandMark Optoelectronics and China’s LuxShare Technology, a subsidiary of Apple-partner LuxShare Precision, media report, noting silicon photonics and optical communications are seen as key technologies for data transmission inside AI data centers. Intel has 30+ years experience in silicon photonics. Inte’s stock INTC 0.00%↑ is down 36% so far just in 2024 already.

US lawmakers have introduced a bill that would ban Intel, TSMC and other CHIPS Act grant winners from using those funds to buy semiconductor tools from China, Russia, North Korea or Iran, Bloomberg reports, a measure aimed at limiting influence on US chip production by said nations, China in particular.

Taiwan and TSCM is a Global Economy Security Risk

I want to state just clearly yet again, Taiwan and in particular TSMC is a semiconductor choke point that is driving the entire AI bull market and many of the semiconductor chips and supply chain which the global economy and companies like Apple and Nvidia depend upon.

Taiwan and its semiconductor industry are one of the biggest choke-points in the world economy. I’m still not sure the U.S., Europe and the world fully realizes this. Diversification away from Taiwan is not possible, as TSMC relies on many local companies and supply chains related to Japan and South Korea directly.

Let’s dive even deeper into the Semiconductor News of the past month or so.