TSMC, Nvidia, ARM Earnings, Geopolitical Conflict Watch, Intel woes, Semiconductor News

Semiconductor Things spawns Semi Reports. 🗃️

Hello Everyone,

This is an issue for the week of ending on May 9th, 2024.

This is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Support me doing this for as low as $1 a week.

Subscribed

Welcome to the 10th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

Analyzing and Curating News 🔔

I’m a news fanatic always analyzing the latest in exponential and emerging tech like robotics, semiconductors & AI chips, quantum, synthetic biology and other fields - as well as BigTech in AI.

When to Expect this Newsletter ⏰

This Newsletter will typically go out on Thursday at 7am Eastern Time. Posts are partially paywalled and paid subscriptions are cheap.

What? It will attempt to summarize some of the most important news in the semiconductor industry of the last week.

🔥 An Exciting Announcement - Semi Reports🐭

To afford to dive more deeply into the semiconductor industry, I have also now launched a new Semiconductor Newsletter that will do more in-depth deep dives (at a higher price point) on particular topics, unlike this Newsletter which is more of a periodic rundown of real-world events in the AI chip, semiconductor space and datacenter future of the world.

It’s still the beginning and concept stages though, so expect deep dives to appear very gradually.

Introducing Semiconductor Reports

For rundowns: Semiconductor Things

For deep dives: Semiconductor Reports

Semiconductor Bits & Bites 📱

🗣️ Rumor Mill Softbank edition: Japanese investment giant SoftBank Group is reportedly in advanced talks to acquire Graphcore, a British AI chip designer that has struggled to gain traction in recent years. Learn More.

〽️ Sad but true INTC 0.00%↑: Intel down a stunning 37% so far this year and the news only gets worse. Intel lowered its 2nd quarter revenue outlook to below the midpoint of previous guidance because of a US ban on chip exports to China’s Huawei Technologies, media report, adding the Q2 forecasted range US$12.5 billion to $13.5 billion remains the same, “but below the midpoint.”

🐸 Nvidia’s next generation AI chip, the R100, will enter mass production on TSMC’s 3nm process in the 4th quarter 2025, and use CoWoS-L packaging, according to noted supply chain analyst Ming-Chi Kuo of TF International Securities, adding servers/racks will be in mass production in the 1st half of 2026. Each R100 will need 8 HBM4 memory chips. The GR200 Grace CPU will also use TSMC 3nm. Nvidia has focused on energy efficiency in R-series chips.

US official says Chinese seizure of TSMC in Taiwan would be 'absolutely devastating'

U.S. Secretary of Commerce Gina Raimondo on Wednesday (May 8) said that if China invades Taiwan and takes control of Taiwan Semiconductor Manufacturing Co. (TSMC), it will have an “absolutely devastating” impact on the U.S. economy reported Reuters and others.

During a hearing held by the House Appropriations Subcommittee on Commerce, Justice, and Science, Representative Jake Ellzey asked what would happen if China invaded Taiwan and locked down the South China Sea to U.S. commerce and took over TSMC. Raimondo replied, “It would be absolutely devastating."

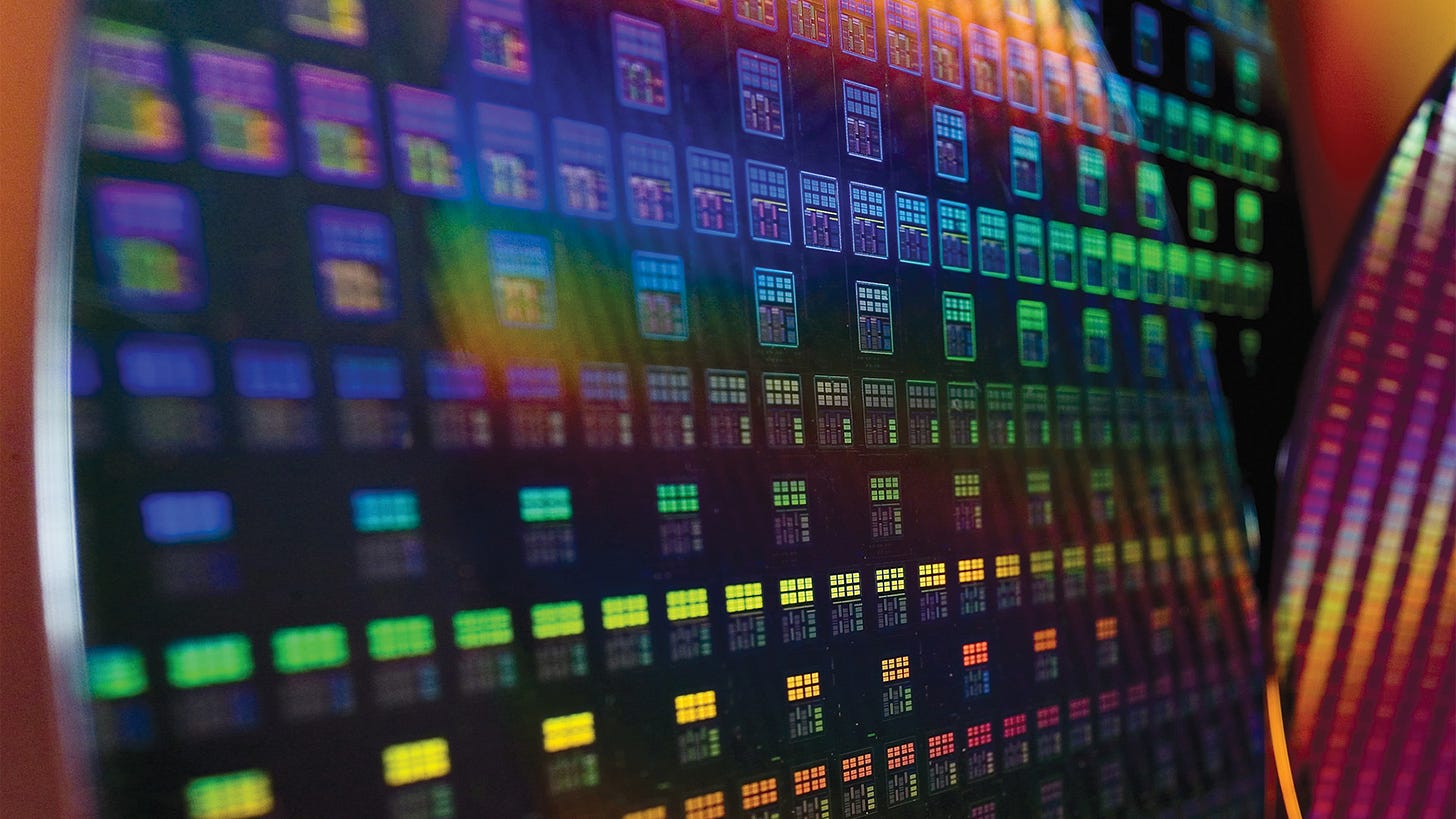

TSMC’s Advanced Packaging Capacity Fully Booked by NVIDIA and AMD Through Next Year

Trendforce reports two major AI giants, NVIDIA and AMD, are fully committed to the high-performance computing (HPC) market. It’s reported by the Economic Daily News that they have secured TSMC’s advanced packaging capacity for CoWoS and SoIC packaging through this year and the next, bolstering TSMC’s AI-related business orders.

TSMC anticipates that revenue contribution from server AI processors will more than double this year, accounting for a low-teens percentage of the company’s total revenue in 2024. It also expects a 50% compound annual growth rate for server AI processors over the next five years, with these processors projected to contribute over 20% to TSMC’s revenue by 2028.

💪🏻 ARM’s Earnings, Pre-market Stock down 8%

Arm Holdings gave a full-year revenue forecast on Wednesday that missed the expectations of investors who had sent the chip designer's shares soaring last September following its IPO on optimism around AI. Shares of Arm fell about 9% in early Thursday trading after the report.

ARM 0.00%↑ Before Earnings, ARM’s stock is up 53% so far this year. For the current fiscal first quarter, Arm forecast revenue in a range between $875 million and $925 million, with a midpoint of $900 million, compared with an average analyst estimate of $857.5 million, according to LSEG data.

Semiconductor Bits & Bites 📱 Continues ~

🕌 Middle East Watch: The CEO of Alat, Saudi Arabia’s new investment fund for semiconductor and AI technology, said it would divest from China if the US asked, but current US requests have focused on keeping supply chains separate, media report. “…if the partnerships with China would become a problem for the US, we will divest,” the CEO said. Alat is backed by US$100 billion from the Public Investment Fund.

🧧 China divesting accelerates: SK Hynix plans to sell a 50% stake in its China foundry unit to China’s state-owned Wuxi Industry Development Group, with 21.3% going for ₩205.4 billion won (US$150.81 million), a separate deal for the intangible assets, including process technology, for ₩123.8 billion, and another 28.6% stake to be sold via a new share offering for an undisclosed sum. The unit is called SK Hynix System IC.

🎌 Back to APAC: Powerchip Semiconductor and Japan partner SBI Holdings will begin mass production at a joint venture semiconductor maker, JSMC, a year earlier than expected in 2026, in order to win market share in Japan, media report, noting JSMC will initially manufacture chips using 28nm-55nm process technology.