TSMC Shines profit surges 39%, Enters "Generational company" territory as AI's backbone.

TSMC is now the ASML of Asia and then some for the world. 🌍

Good Morning,

If TSMC is any indication, BigTech is going to have a great earnings in about two weeks. To say that TSMC underpins the AI demand for compute movement would be an underestimate. As you might know, TSMC has benefited from the artificial-intelligence megatrend as it manufactures advanced AI processors for clients, including Nvidia and Apple.

As dominant ASML is in Europe, TSMC is now in Asia.

As Asia’s largest technology company by market capitalization, TSMC has benefited from the artificial-intelligence boom, producing advanced AI processors for clients such as Nvidia and Apple.

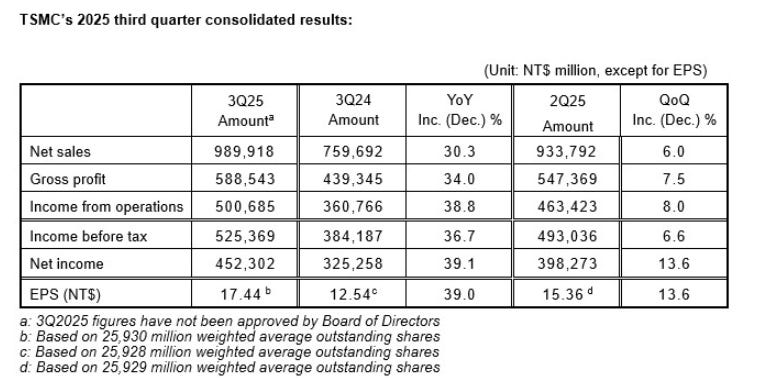

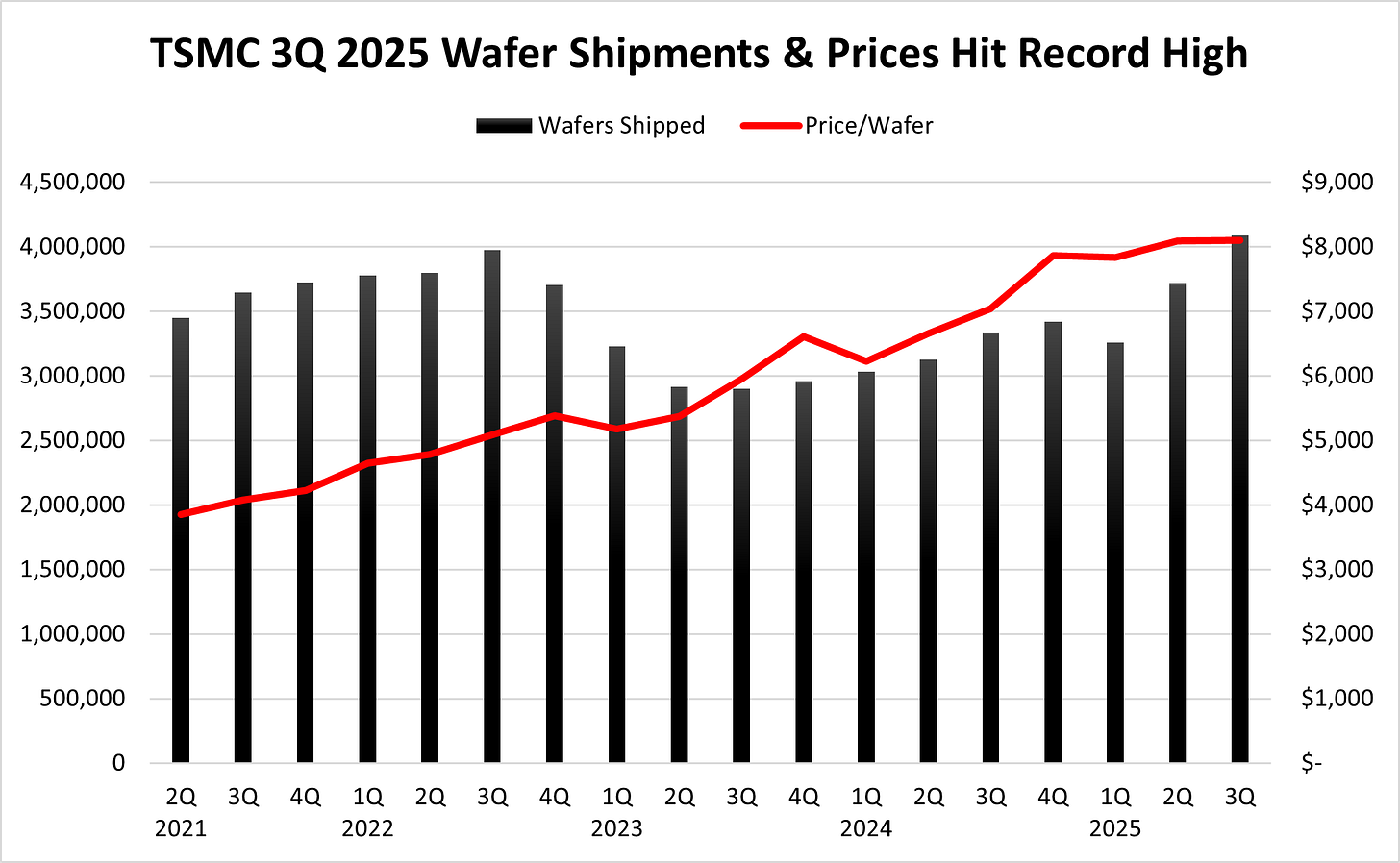

Year-over-year, third quarter revenue increased 30.3%, while net income and diluted EPS increased 39.1% and 39.0% respectively.

TSMC’s high-performance computing division, which encompasses artificial intelligence and 5G applications, made up the majority of third-quarter sales accounting for 57% of revenues.

TSMC also increased its expected floor for capacity expansion and upgrades to $40 billion for the full year, up from a previous floor of $38 billion.

It costs AI players around $50bn to build each gigawatt of AI capacity, TSMC CEO CC Wei said Thursday. Wei declines to say how much of that flows to TSMC. - Tim Culpan.

There is no Nvidia without TSMC, there is no OpenAI without Nvidia. All the vendor financing in the world around AI Infrastructure revolves around TSMC now, it’s incredible supply chain in TAiwan as it continues to expand in Arizona, USA.

While Nvidia has incredible margins, the real ‘picks and shovels’ play really is TSMC of course. Odd how so many investors and analysts still don’t fully understand this. The demand for compute acceleration of the 2020s is going to great a giant in TSMC and we’re starting to see this in 2025 more clearly.

“Our advanced packaging revenue is approaching 10%, a significant portion of our revenue, and it’s important to our customers.” - TSMC, CEO.

Image credit: Jasper Juinen | Bloomberg | Getty Images

ASML Earnings this Week Too

Netherlands based ASML continues to benefit from the AI boom with investments helping fuel orders of 5.4 billion euros ($6.28 billion) in the third quarter.

However, CEO Christophe Fouquet warned that the firm expects customer demand and sales in China to decline significantly next year compared to 2024 and 2025.

Let’s now do our round-up of the last three weeks in Semiconductor news with our usual focus on Taiwan, South Korea and Japan. This information is curated from analysts mostly located in Taipei.

To give you some context as to how 2025 is a turning point for the future of technology, 2025 will be the year Nvidia tops Apple as TSMC’s biggest customer. Unimaginable even three years ago.

I might be biased since I live in Taiwan currently, but I don’t think so - TSMC’s position is beyond criticism and in a scenario where the demand for compute keeps going up - likely the most crucial tech company in the world. One that is not fully baked into their stock TSM 0.00%↑ due to geopolitical concerns. As such, this issue is going to focus even more on TSMC than usual!