AMD's new AI chip, TSMC innovates, SK Hynix Warns of Trade Tariff impacts, U.S. Taiwan Semi ties Deepen

Demand for compute continues to rage, global partnerships thrive.

Welcome Back!

Over the summer we may be reporting a bit less than usual on this publication regarding the semiconductor News cycle. In case you missed it, check out the coverage of last week.

There’s never been a more exciting time to follow the semiconductor industry:

I try and curate the top semiconductor events of the past 14-21 days, following Semiconductor analysts on X, among other sources. I try to package it so anyone could get the broad strokes of the last weeks in an easy to absorb format, mostly bullet points. I ask for very modest fees and do not make a profit from this activity.

Visit the archives

Visit the archives.

I do this on top of my usual AI coverage, Quantum computing and emerging tech curation, Op-Eds and guest post collaborations.

AMD’s new Chip

Their new lineup is a big deal to me: MI400 series of chips will be the basis of a new server called "Helios" that AMD plans to release next year. The chips will be able to be used as part of a “rack-scale” system, AMD said. That’s important for customers that want “hyperscale” clusters of AI computers that can span entire data centers.

The new AMD Instinct™ MI350 Series accelerators look impressive as AMD wagers to become more competitive in the AI chip market that continues to accelerate. Both Huawei and AMD have been making better than anticipated progress even with Nvidia’s dominance in the market. There’s clearly enough room for competitors to thrive as well. AMD 0.00%↑’s stock was up about 10% on the news.

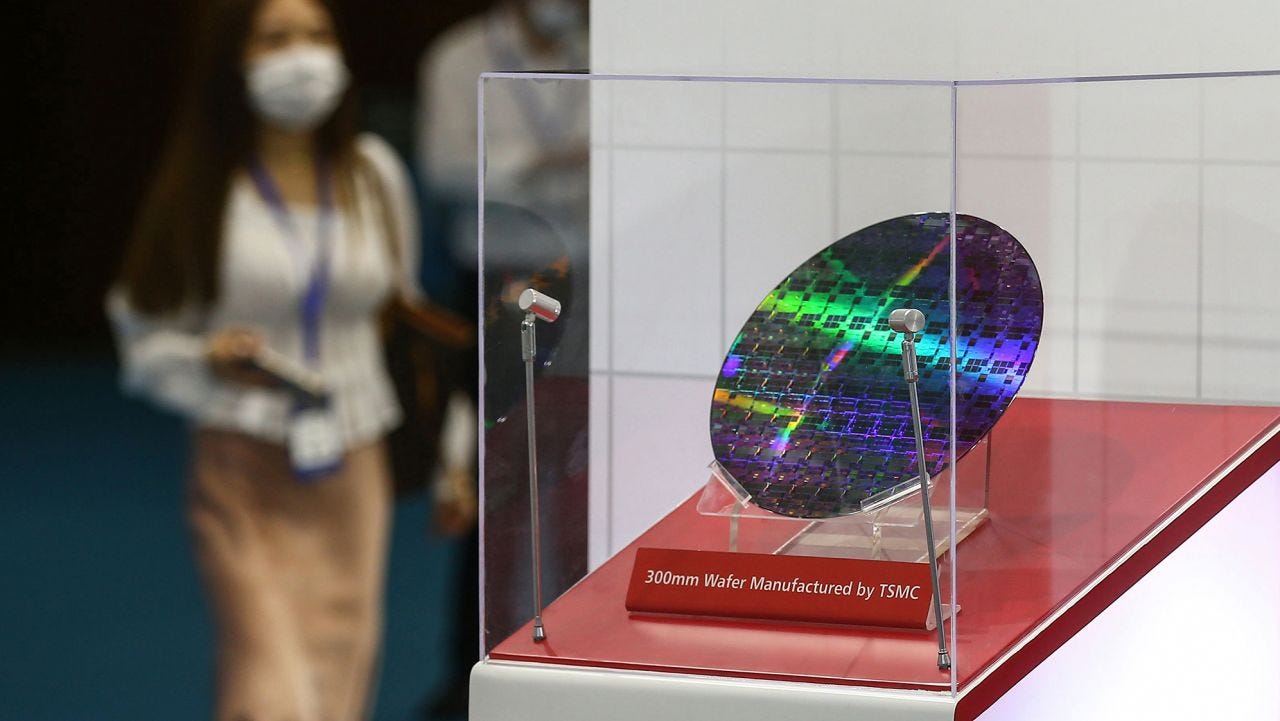

TMSC projects Stunning Growth

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) further solidified its dominance in the global wafer foundry business in the first quarter of this year, remaining far ahead of its closest rival, Samsung Electronics Co, TrendForce Corp (集邦科技) said about a week ago. Taiwan Semiconductor Manufacturing Co. (TSMC) reported consolidated revenue of NT$320.52 billion (US$9.86 billion) for May 2025, down 8.3% from April but up 39.6% compared to May 2024. TSMC posted US$25.52 billion in sales in the January-to-March period, down 5 percent from the previous quarter, but its market share rose from 67.1 percent the previous quarter to 67.6 percent, TrendForce said in a report. On the NYSE, TSM 0.00%↑ TSMC’s stock is up nearly 22% during the last year.

The AI bull market has lifted many semiconductor and AI hardware and datacenter related stocks. I do have a Emerging tech stocks Newsletter as well that I will be updating soon with my top picks.