Cerebras is going IPO, Intel's Woes magnified, TSMC news all around~ stormy weather.

Micron's Stock surges, Huawei is coming!

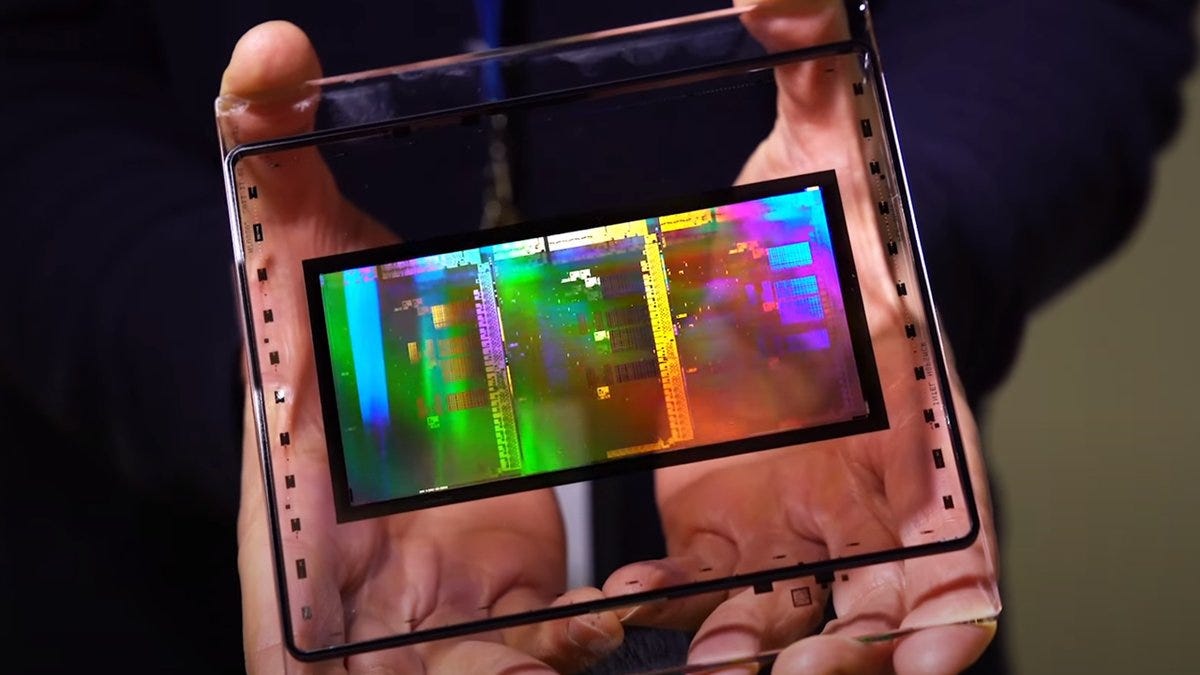

Image Credit: Corning unveils Extreme ULE glass for use in next-generation microchip production.

Hello Everyone,

I’m getting ready in this leaky old house for Typhoon Krathon here in Taiwan, the winds are starting to pick up as I’m writing this. ⛈️ Sort of like Intel in recent times. 😨

This is an issue for the week up to October 3rd, so let’s catch up on the last two weeks. We go into some depth, and not enough happens sometimes during a one week period.

In case you are new as well, this is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Support me doing this for as low as $1 a week. Please see my archives for more on what to expect.

Welcome to the 17th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

Analyzing and Curating News 🔔

I’m a news fanatic always analyzing the latest in exponential and emerging tech like robotics, semiconductors & AI chips, quantum, synthetic biology and other fields - as well as BigTech in AI.

When to Expect this Newsletter ⏰

This Newsletter will typically go out on Thursday at 7am (sometimes as late as 9am) Eastern Time. I’m sometimes late. I sometimes skip weeks. Posts are partially paywalled and paid subscriptions are cheap.

What? It will attempt to summarize some of the most important news in the semiconductor industry of the last week.

For rundowns: Semiconductor Things

For deep dives: Semiconductor Reports (still in Research mode atm).

If you enjoy my coverage of emerging tech and the semiconductor News curation, you might enjoy my dabbling in AI as well.

To read the last or previous issue go here.

🌍 Semiconductor Bits & Bites 📱

South Korea insights: ‘Artificial Intelligence creates DRAM divide’ South Korean media trumpet, as analysts are more bullish on SK Hynix’s 3rd quarter (Q3) earnings than Samsung’s, due to SK Hynix’s leadership in AI memory chips called HBM (high bandwidth memory), which uses multiple DRAM die inside small packages. Read the full story.

🌪️ Odd Storms: Semiconductor makers are monitoring quartz supplies after Hurricane Helene shut key mines in North Carolina, but major firms including TSMC, Samsung, SK Hynix so far say they do not expect any impact to operations, Bloomberg reports. Quartz miners Sibelco and Quartz Corp. both suspended operations 9/26 due to flooding and power outages, and say it’s too early to say when production will resume.

Is TSMC out-competing Samsung? TSMC is winning chip orders from South Korean AI chip developers away from Samsung Foundry, media report, including Furiosa AI, which will have its Renegade chip made on TSMC’s 5nm process with CoWoS packaging in 2025, after using Samsung previously, while DeepX also moved to TSMC from Samsung for 12nm production of its DX-V3 chip, and Mobilint plans to transfer its latest AI chip to TSMC 12nm after using Samsung for its 1st AI chip. Taiwan media cite ZDNET Korea for the information.

TSMC (Taiwan) will be the big winner as smartphone chip clients Qualcomm and MediaTek release new 5G flagship chips in October, media report, with Qualcomm set to reveal the Snapdragon 8 Gen4 at the Snapdragon Forum later this month, while MediaTek will release the Dimensity 9400 on Oct. 9. Both are expected to be made on TSMC’s 3nm process, the most advanced process in high volume production today.

Video of the Week

- D. Patel interviews Sustack and YouTube legends on “How the Semiconductor Industry Actually Works”

Watch it here. While lighthearted at times, these are some serious topics.

🌍 Semiconductor Bits & Bites 📱

⚡ Now that’s energy! TSMC’s electric bill will increase NT$11.2 billion (US$351 million) per year due to the new 12.5% rate hike that will take effect 10/16 in Taiwan, media report, noting the new price increase follows a 25% hike in April. The combined price hikes will add NT$28.9 billion (US$906 million) to TSMC’s electric bill this year, an estimate based on TSMC’s 2022 power consumption of 21 billion kilowatt-hours (a big year for chips).

Inside China: The Qualcomm vs MediaTek (Taiwan, founded in 1997) 3nm chip battle for China’s smartphone market is about to begin, with Qualcomm’s Snapdragon 8 Gen4 squaring off with MediaTek’s Dimensity 9400 application processors, media report. Prices of the 2 high end chips will be about 20% higher than previous flagship 5G chips, but MediaTek’s chip will also reportedly sell for about 20% less than its Qualcomm rival.

All production lines at China chip foundry Hua Hong Semiconductor (China, founded in 1996) , a mature process foundry, are fully loaded, with 100% utilization at 8-inch and its 12-inch fab, as China steps up localization efforts, media report, noting pilot production at Hua Hong’s 2nd 12-inch fab will begin by end-2024. Taiwan chip design firms have started moving some orders back to Taiwan foundries. Hua Hong and TSMC are reportedly the only 2 foundries in the world today at 100% utilization.

Nvidia competitor Cerebras files for U.S. IPO

Cerebras was founded in 2015.