The Semiconductor Boom Times: coming soon: 2025-2030 'Blackwell Surge Era'

Big things are coming. South Korea surges, Taiwan builds, Intel falls. Middle East collusion begins. Geopolitics is everywhere now in Tech, Semiconductor things especially. 🤔

Hello Everyone,

This is an issue for the week up to September 19th, so let’s catch up on the last two weeks. We go into some depth, and not enough happens sometimes during a one week period.

What cadence would you prefer?

In case you are new as well, this is one of my “new” Newsletters, and over 10+ now covering various aspects of emerging tech. Thanks for the support, I hope to learn along with you about these topics.

Support me doing this for as low as $1 a week. Please see my archives for more on what to expect.

Welcome to the 16th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

With the rise of Generative AI, Nvidia and TSMC and the geopolitical importance of Taiwan, this is now a major topic of me in my watching of the emerging tech space that I do as an analyst, writer, curators and news watcher.

The Technology category is an underdog relative to Substack’s baseline audience, this means I’m an outlier here. To survive, I’m building 10+ Newsletters in “emerging tech” coverage. A pilot never seen before on Substack for a one-person team. Full disclosure, I may not make it.

Importe note: I am not native to the Semi space, and it might take a while to get up to speed. So we’ll be effectively learning about these things together.

Analyzing and Curating News 🔔

I’m a news fanatic always analyzing the latest in exponential and emerging tech like robotics, semiconductors & AI chips, quantum, synthetic biology and other fields - as well as BigTech in AI.

When to Expect this Newsletter ⏰

This Newsletter will typically go out on Thursday at 7am (sometimes as late as 9am) Eastern Time. I’m sometimes late. I sometimes skip weeks. Posts are partially paywalled and paid subscriptions are cheap.

What? It will attempt to summarize some of the most important news in the semiconductor industry of the last week.

For rundowns: Semiconductor Things

For deep dives: Semiconductor Reports (still in Research mode atm).

South Korea Overtaking the U.S.

Intel’s collapse could benefit South Korean firms like SK Hynix.

🌍 Semiconductor Bits & Bites 📱

SK Hynix (founded 1983) may overtake Intel in quarterly revenue for the 1st time ever in the 3rd quarter as the South Korean firm and rival Samsung Electronics post record high sales driven by the AI memory chip boom in HBM (high bandwidth memory), media report, citing market researcher Omdia. Nvidia is expected to lead semiconductor sales with US$28.1 billion, with Samsung 2nd at $21.71 billion and SK Hynix in 3rd place at $12.83 billion. Intel is expected to drop to 4th place with $12.13 billion in revenue.

TSMC Arizona is already manufacturing Apple’s A16 chips, used in iPhone 14 and iPhone 15, with its N4P process, “in small, but significant numbers” and “volume will ramp considerably” as TSMC works to meet its production target for the 1st half of 2025, reports one industry watcher, who called it significant. “The fact that they went for the most-advanced chip they could manage on US soil, in terms of both technology and volume, shows Apple and TSMC want to start big.”

TSMC Supremacy: TSMC’s new 2nm fabs in Kaohsiung, Taiwan are gearing up to begin operations, media report, with the 1st fab to be up and running in the 1st quarter next year, the second in the 3rd quarter and TSMC will break ground on the 3rd fab this month (September). TSMC is also considering two more fabs for 1.4nm in the area.

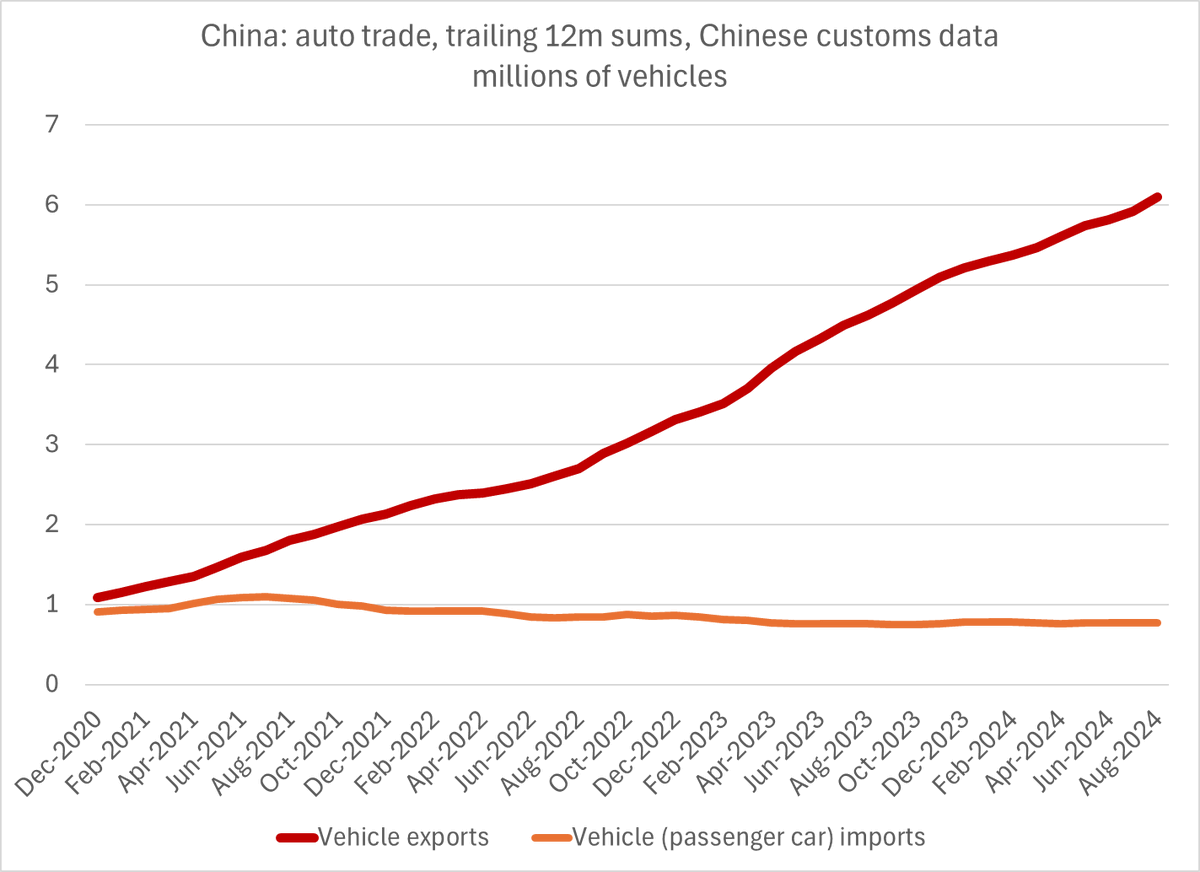

‘China the Maker’; when will this come to the Semiconductor supply chain and GPUs? (sooner than you might think)

A world where China is a net exporter of 5m vehicles (6m exports v 1m imports) is a huge shift. For EVs it’s dominant now by 2025.

Microsoft, BlackRock to launch US$30b AI infrastructure fund

The plan is to launch a more than $30 billion fund to invest in artificial intelligence infrastructure to build data centers and energy projects, the companies said on Tuesday. This could actually become a fairly powerful consortium that includes Middle East players.

Global investors BlackRock, Global Infrastructure Partners (GIP) and MGX have joined with tech giant Microsoft to launch a new artificial intelligence partnership, with plans to invest in data centres and support power infrastructure. This might impact both data center and the future of the energy sector that will support AI supercomputers of the future! I consider it big news.