Nvidia's Scary Rise, Broadcom, DeepSeek, Taiwan's $100 Billion Pledge and the great semiconductor uncertainty

The pressure is on, GTC is on the horizon, Broadcom blows through Earnings.

Welcome Back,

I’ve been under the weather so missed the Thursday 07:00 AM schedule, so making it up on Friday today this morning. Today’s semiconductor news is for the last 15 days. Trade tariffs and macro geopolitics has been putting pressure on Tech and semi stocks.

Welcome to the 25th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow.

I’ll skip the long intro today, because we have a lot of catch-up to cover.

Previous Issues

Trump Tariffs on Semis, Broadcom ᱝ Eats Intel, TSMC under the bus🚌, Microsoft Quantum, and other Geopolitical worries of Semis con't.

Semiconductor Earnings, Huawei Ascend 910C via DeepSeek, Samsung joining Stargate? Lunar new year and Semi surprises.

TSMC into the Global limelight in 2025, Nvidia under pressure, Geopolitics anticipating Trump State, U.S. ramps up China Export controls even further

Intel Loses CEO, Google Trillium, Nvidia Earnings, Amazon Trainium 2 and More Trade Wars

OpenAI's AI Infrastructure plans, AMD Layoffs, ASML Projections, U.S. playing the "Taiwan Card" could hurt both China and Taiwan.

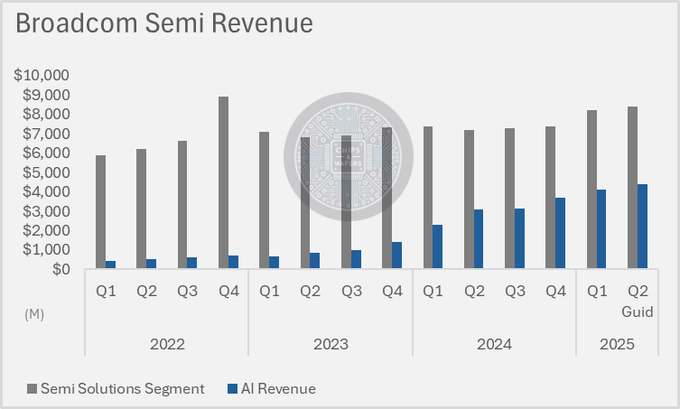

Broadcom Earnings

Broadcom reported first-quarter earnings on Thursday that topped analysts’ expectations, and offered strong guidance for the current quarter.

Broadcom said it expects about $14.9 billion in second-quarter revenue, higher than the $14.76 billion forecast by Wall Street analysts. Revenue in the last quarter rose 25% from $11.96 billion a year earlier. The stock should be up in the 5-10% range today and it gives the AI chip sector more confidence in the macro picture.

Nvidia Earnings

Nvidia’s revenue in the quarter rose 78%, and full fiscal-year revenue for Nvidia rose 114% to $130.5 billion. Some analysts were looking for more! Nvidia said it expected about $43 billion in first-quarter revenue, plus or minus 2%, versus $41.78 billion expected per LSEG estimates. It tends to like to under-promise and over deliver.

Chief Financial Officer Colette Kress said the company expects “a significant ramp” of sales of Blackwell, its next-generation AI chip, in the first quarter. However the stock has been under significant pressure since DeepSeek-R1’s announcement. Nvidia’s stock is down 20% so far in 2025.

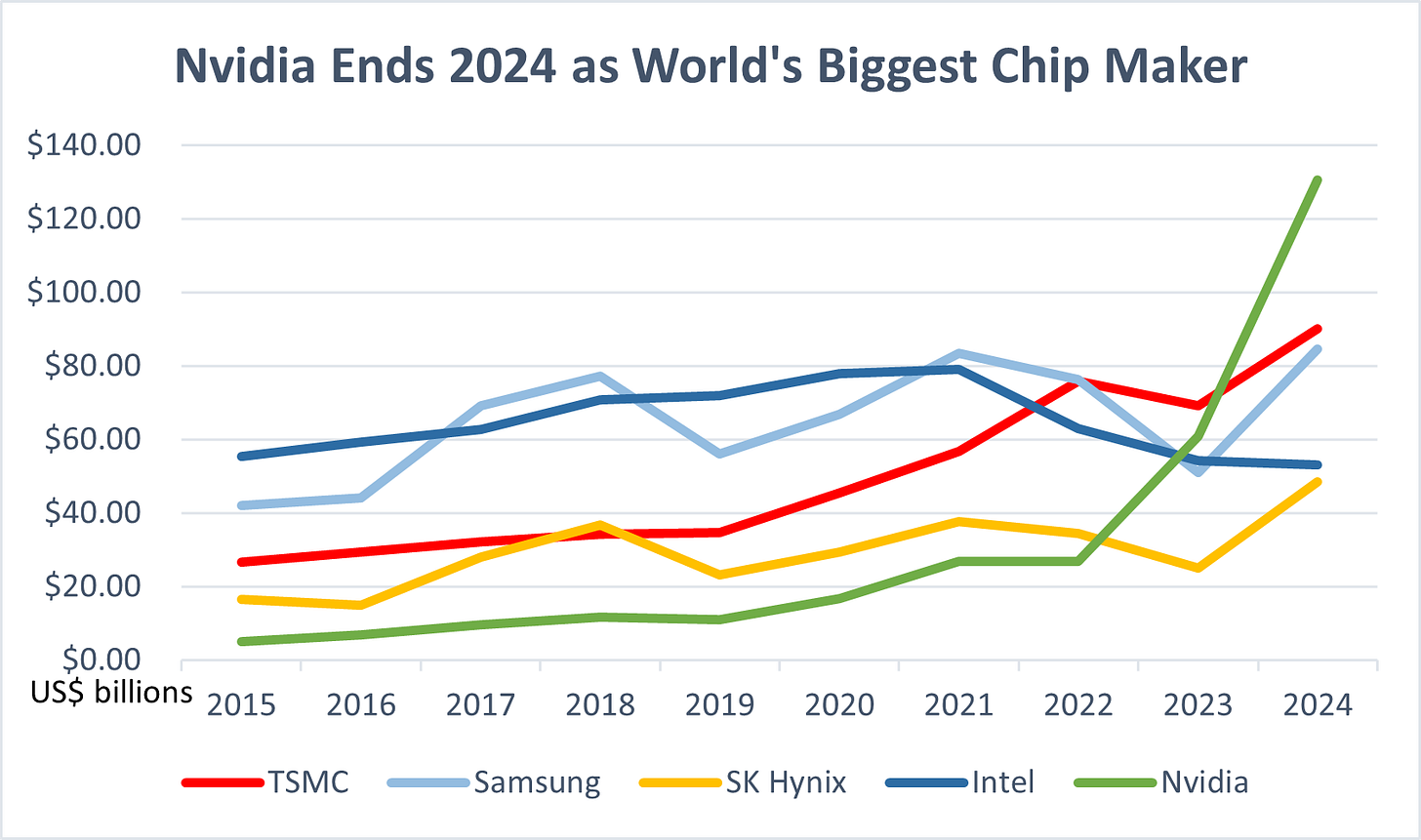

Nvidia’s Sudden Rise 🚀

Nvidia became the world’s biggest semiconductor company of any kind in 2024, as annual revenue rose 114% to US$130.50 billion.

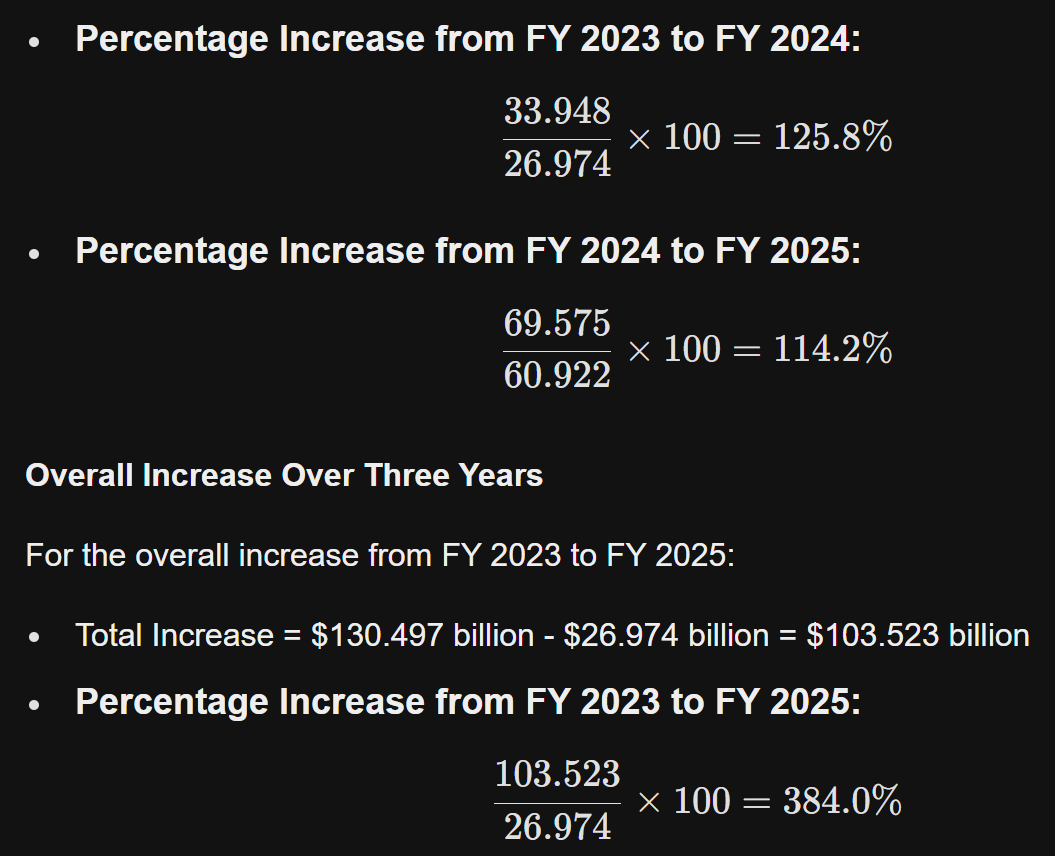

Nvidia has seen significant revenue growth over the last three years. In 2022, the company's revenue was $26.974 billion, and by fiscal 2025, it had grown to an impressive $130.5 billion.

Fiscal Year 2023: Nvidia had a revenue of $26.974 billion.

Fiscal Year 2024: The revenue increased to $60.922 billion, which was a significant rise from the previous year.

Fiscal Year 2025: Nvidia reported annual revenue of $130.497 billion, continuing the upward trend.

Stock Performance 2022-2025

Over the past three years, NVIDIA Corporation's stock (NVDA) has experienced substantial growth. Specifically, the stock performance over this period is remarkable, revealing a phenomenal increase of approximately 984.81% from a notably lower price level.