Intel Loses CEO, Google Trillium, Nvidia Earnings, Amazon Trainium 2 and More Trade Wars

Volatile Trade wars and Intel's crushing demise highlight tensions.

Hello Everyone,

Welcome to the 21st edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow. Due to Thanksgiving we skipped a week, so this post will be a bit more epic than usual.

Usually this Newsletter is twice a month, sometimes a bit more.

This Newsletter explores TSMC, Taiwan and Nvidia in particular. Earnings are a lot of what I want to cover on an ongoing basis.

I’m convinced that in 2024 watching the AI chips and Semiconductor space is actually the most interesting it’s been in decades.

Support me doing this for as low as $1 a week. Please see my archives for more on what to expect.

Typically now the Newsletters comes out two or three times a month, usually around Thursday morning (ideally at 7-9 AM EST window). Functionally often a bit late. More frequent publications might appear on Friday or even Saturdays for premium readers.

The Newsletter is mostly concerned with micro events in the semiconductor News cycle.

🔵 As I cover emerging tech over a wide spectrum, curating the AI chip and Semiconductor News forces me to keep in touch with the industry news cycle and keep learning about the various companies involved.

⚫ Today’s issue covers approximately the period of November 14th to December 12th, 2024.

⚪ I will be tracking some breaking news and writing some Op-eds here. Though this has been slow to get off the ground. We are behind schedule.

While it’s challenging to summarize such a busy space, you could get away with just following this Newsletter, and you’d be okay.

Previous Issues

OpenAI's AI Infrastructure plans, AMD Layoffs, ASML Projections, U.S. playing the "Taiwan Card" could hurt both China and Taiwan.

SK Hynix Boom, AMD's Poor Guidance, China's Evasive Maneuvers, Earnings coming into Focus

TSMC Earnings, ASML Woes, Nvidia's Blackwell Demand, Meta's Weird Datacenter Overhaul

Cerebras is going IPO, Intel's Woes magnified, TSMC news all around~ stormy weather.

The Semiconductor Boom Times: coming soon: 2025-2030 'Blackwell Surge Era'.

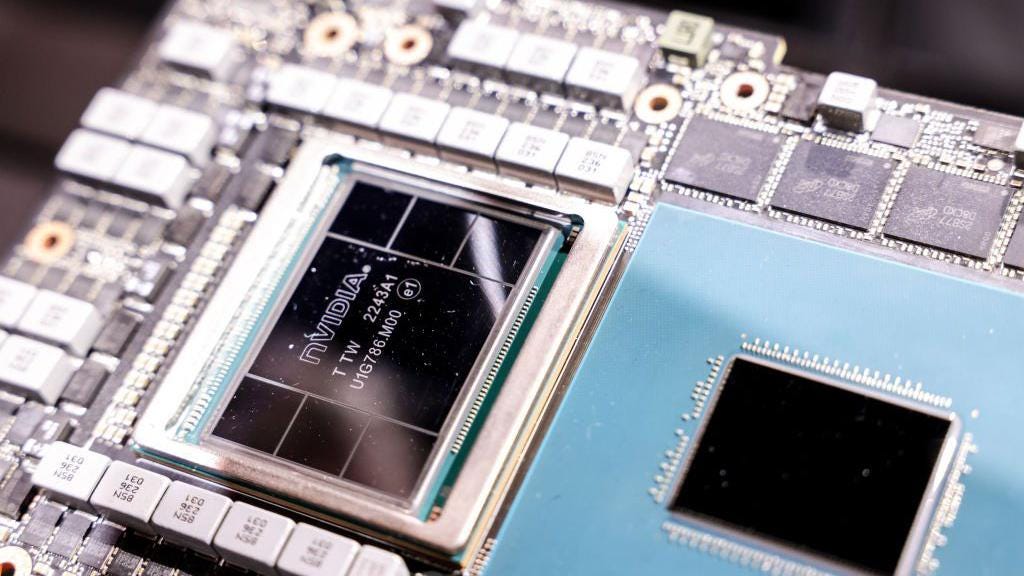

Nvidia Earnings

On November 20th, Nvidia reported third-quarter earnings that beat expectations for sales and earnings while delivering a better-than-expected forecast for the current quarter. Revenue continues to surge at Nvidia, rising 94% on an annual basis during the quarter that ended on Oct. 27. Read full review.

Nvidia’s stock NVDA 0.00%↑ is up another astounding 189% year to date. In early December after some Trade sanctions, China opened a probe of the AI chip company for violating anti-monopoly laws. Read coverage. Nvidia makes around 17% of its sales from China and that figure is actually rising. China trade retaliations to more sanctions include valuable rare minerals to the U.S. relevant to the semiconductor supply chain.

Nvidia on in the Trade Wars Cross-fire?

Will China’s probe impact future Nvidia sales? Will the Trade war continue to escalate when Trump takes power? U.S. exceptionalism means that the Biden administration keeps broadening limits on Chinese access to advanced microchip technology, with Donald Trump expected to go even further. In late November, Trump vowed to add another 10% to Trade tariffs on China. You might recall that Trump had threatened tariffs of 60% on Chinese goods while campaigning for president.

We have so much to cover, so let’s get started.