SK Hynix Boom, AMD's Poor Guidance, China's Evasive Maneuvers, Earnings coming into Focus 🔎

Apple, Australia, India, Taiwan, Japan and South Korea news, a very complicated global situation. TSMC forever! 🗿 all day long with Typhoons. ⛈️

Hello Everyone,

Welcome to the 19th edition of Semiconductor Things™, where I seek to break down some of the news in the Semiconductor, AI chips and datacenter space globally to make it more accessible and easy to follow. Usually this Newsletter is twice a month, sometimes a bit more.

This Newsletter explores TSMC, Taiwan and Nvidia in particular. Earnings are a lot of what I want to cover on an ongoing basis.

I’m convinced that in 2024 watching the AI chips and Semiconductor space is actually the most interesting it’s been in decades.

Support me doing this for as low as $1 a week. Please see my archives for more on what to expect.

Typically now the Newsletters comes out two or three times a month, usually around Thursday morning (ideally at 7-9 AM EST window). Functionally often a bit late.

The Newsletter is mostly concerned with micro events in the semiconductor News cycle.

🔵 As I cover emerging tech over a wide spectrum, curating the AI chip and Semiconductor News forces me to keep in touch with the industry news cycle and keep learning about the various companies involved.

⚫ Today’s issue covers approximately the period of October 17th to October 31st, 2024.

⚪ I will be tracking some breaking news and writing some Op-eds here.

Previous Issues

TSMC Earnings, ASML Woes, Nvidia's Blackwell Demand, Meta's Weird Datacenter Overhaul

Cerebras is going IPO, Intel's Woes magnified, TSMC news all around~ stormy weather.

The Semiconductor Boom Times: coming soon: 2025-2030 'Blackwell Surge Era'

🌍 Semiconductor Bits & Bites 📱

Chronological from the present day backwards:

The US and Taiwan will begin talks to “reduce double taxation barriers for further investment by Taiwan into the United States, and vice versa, particularly for the small and medium-sized enterprises that are crucial to a complete semiconductor ecosystem,” The US Treasury said, adding a tax agreement is important as the US and Taiwan have no formal diplomatic relations, so income for Taiwan businesses and individuals operating in the US can be taxed by both governments. Read It on BNN.

OpenAI is working with Broadcom on a custom chip design, which will be manufactured by TSMC next year, media report, adding OpenAI no longer wants to build its own chip manufacturing plants “due to the costs and time needed to build a network.” OpenAI will also buy AMD chips (GPUs) in addition to Nvidia GPUs for its AI servers. The custom OpenAI chip will be for inference, and is not a GPU.

Apple exported nearly US$6 billion worth of iPhones from India in the 6-months through September, up by a third compared to a year ago, putting annual exports on track to surpass $10 billion in fiscal 2024, Bloomberg reports, adding Apple is expanding its manufacturing network in India at a rapid clip as it works to reduce its dependence on China, amid US-China tensions. I recently wrote on India’s prospects in AI and a VC boom here.

Rare metals ⚠︎: Australia is looking at mining waste as a potential supply source of gallium and germanium, materials essential to cutting edge semiconductors, after China’s decision to tighten export controls on the elements, Nikkei reports, noting Australia believes it could help allay concerns over the elements. An Australian official noted there is a lot of gallium in alumina refining, which currently isn’t captured, and a lot of germanium in zinc refining, also not currently captured – but both could be.

“AMD said its important data center business doubled in sales for the second quarter in a row.”

AMD shares fall as forecast fails to impress despite strong AI growth

Advanced Micro Devices reported third-quarter results on Tuesday, with earnings in line with forecasts and revenue that slightly beat expectations. However guidance didn’t impress. It really wasn’t so bad, AMD reported revenue of $6.82 billion, exceeding expectations of $6.71 billion. This represents an 18% increase year-over-year and a 17% increase from the previous quarter. Wall Street wasn't too keen on the company's Q4 revenue outlook, which it said will come in between $7.2 billion and $7.8 billion. Wall Street was looking for $7.55 billion. Read the details here and here.

🌍 Semiconductor Bits & Bites 📱

TSMC has cut off at least 2 chip clients over potential links to China’s Huawei, on suspicion they were trying to circumvent US export controls, Nikkei reports, citing unnamed sources. Both companies had placed 7nm orders to TSMC and gradually increased the volume, raising alarms at TSMC. The report does not name the two firms.

SemiAnalysis: The US is playing semiconductor whack-a-mole with China, which is surging forward in AI, a key national security concern. What will the world look like if China wins in AI, gaining expert-level science and engineering or with human-or-better cognition (AGI)? SemiAnalysis continues: “There are enough chips being shipped to China + manufactured domestically to create the world’s largest AI training cluster. For the most part, AI chips are decentralized in China with the largest known clusters 1/3 the size of the largest US ones, but a concentration of efforts could lead to cluster sizes that dwarf those in the US in less than a year.”

Special Report: “Our months-long investigations found Russia is binge buying the world’s most coveted Nvidia AI chips despite sanctions. A mysterious Indian pharma company is pulling the strings.” Read the Bloomberg piece.

Samsung Electronics’ ability to manage crises is causing growing scrutiny ahead of its 3rd quarter earnings call, as earnings have slowed due to its struggles with AI memory chips, HBM3e (high bandwidth memory, 5th generation), media report, noting troubles at the company are rooted in a souring corporate culture, in which excessive competition between executives is damaging chip yields at the firm, a problem mirrored in its foundry business, which is struggling with 3nm chip yields.

Inside the 100K GPU xAI Colossus Cluster that Supermicro Helped Build for Elon Musk

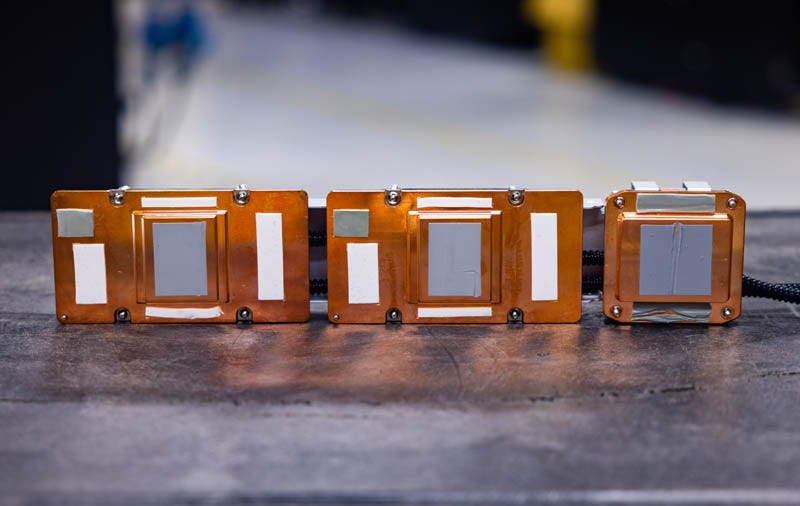

In only 122 days xAI built its Colossus Supercomputer. It’s Elon Musk’s xAI that built a giant AI supercomputer in Memphis, this is that cluster. With 100,000 NVIDIA H100 GPUs, this multi-billion-dollar AI cluster is notable not just for its size but also for the speed at which it was built so if you are interested in some inside details here you go.

The basic building block for Colossus is the Supermicro liquid-cooled rack. This comprises eight 4U servers each with eight NVIDIA H100’s for a total of 64 GPUs per rack. Eight of these GPU servers plus a Supermicro Coolant Distribution Unit (CDU) and associated hardware make up one of the GPU compute racks.

Supermicro’s motherboard integrates the four Broadcom PCIe switches used in almost every HGX AI server today instead of putting them on a separate board. Supermicro then has a custom liquid cooling block to cool these four PCIe switches.